US Dollar, GBP, EUR Price Analysis & News

- Eurozone Heading for Lockdown

- USD Bid Modest as Markets Remain Watchful of US Election

Eurozone Heading for Lockdown

Another wave of risk aversion this morning with European equities under notable pressure. This came after reports that France are mulling a possible month-long national lockdown, which shouldn’t entirely be a surprise given the trajectory of virus cases in Europe in recent weeks. French President Macron will also address the nation today at 20:00 local time. Elsewhere, concerns in the Eurozone were further compounded by Germany discussing a two-week lockdown from roughly November 4th until the end of November.

USD Bid Modest as Markets Remain Watchful of US Election

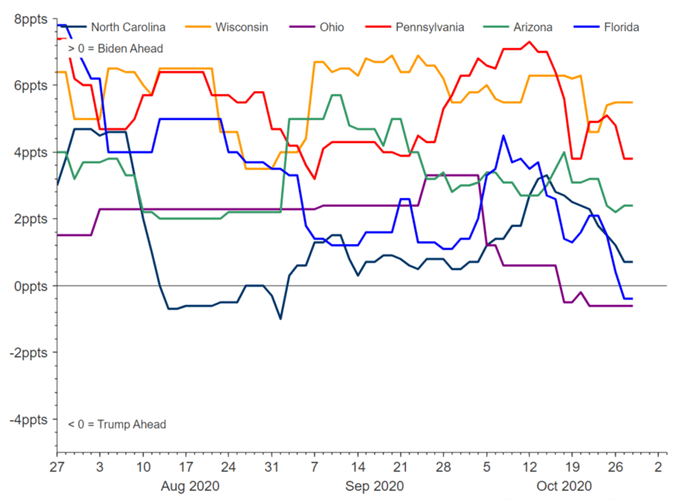

However, all things considered, while the USD has been underpinned by safe-haven flows, the moves across FX have been largely rather modest given that markets remain cognisant of the US election next week. As I have mentioned previously, positive drivers for the Eurozone have been fading for some time now. While this would normally leave a market that is extremely long the Euro vulnerable to a deeper setback, given that markets continue to price in a democrat sweep (a USD negative outcome), the Euro appears likely to find some demand down towards 1.17. Although, it is important to point out that Trump has been gaining ground in key states in recent days, casting a doubt to the certainty over a democrat sweep.

| Change in | Longs | Shorts | OI |

| Daily | -1% | -4% | -3% |

| Weekly | 4% | -10% | -5% |

Trump Gaining Ground in Key States

Alongside this, the weakness observed in the Euro has also seen GBP/USD dragged lower as the pair breaks below 1.3000. While my base case is for a trade agreement between the UK and EU, with negotiations in the tunnel phase, Brexit headlines are been quiet in recent sessions and given that the deadline is not for another two more weeks, short-term risks for GBP/USD are for a 1.2900 test.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |