Crude Oil, CAD, NZD Analysis & News

- WTI Crude May Contract Tanks Ahead of Expiration

- CAD at Risk From Deteriorating Terms of Trade

- NZD Outperforms with Lockdown Measures Set to Ease

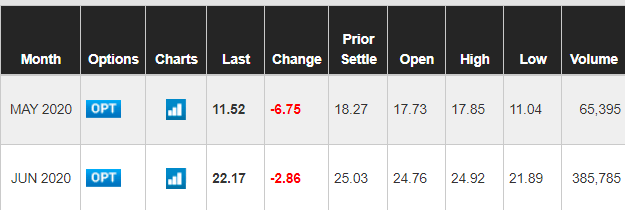

Oil: The drop in oil prices has been grabbing the headlines with WTI trading below $12/bbl. However, the move has been largely concentrated in the May contract, which expires tomorrow. As such, most of the volume is in the June contract which trades at $22/bbl and thus the spread between front and second month is the widest on record (over $10). Consequently, volatility will likely persist in the run-up to expiration. Alongside this, short-term factors look set to weigh on oil prices, particularly as concerns over a lack of storage persists with eyes on Cushing storage (capacity of 76mln, current inventory of 55mln).

Oil Trading: Strategies and Tips

Figure 1. June Contract Better Reflects the Price of Oil

Source: CME. June Contract Trading at 5 Times the Volume Than May.

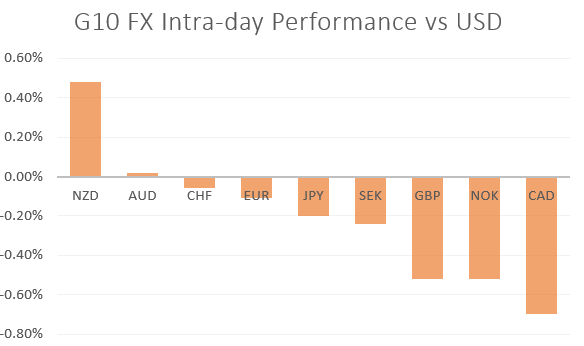

CAD: For commodity currencies such as the Canadian Dollar, low oil prices continue to weigh. More importantly, Canada’s major grade of oil (Western Canadian Select) had been trading with negative prices, which would theoretically mean that producers would pay buyers to take oil away. That said, with the significant deterioration in Canada’s terms of trade, the Canadian Dollar looks set to remain soft.

NZD: The New Zealand Dollar outperforms as NZ looks to ease lockdown measures on April 27th with companies being allowed to get ready to open for business this week. Elsewhere, the upside beat in Q1 CPI had also provided a mild lift to NZD.

Source: Refinitiv, DailyFX

WHAT’S DRIVING MARKETS TODAY

- “British Pound Latest (GBP): Brexit Talks May Weigh on GBP/USD” by Nick Cawley, Market Analyst

- “EUR/USD Longs Rise as US Dollar Selling Continues – COT Report” by Justin McQueen, Market Analyst

- “Gold Price Back Below March High, Levels to Watch” by Paul Robinson, Market Analyst

--- Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX