Talking Points:

- The combination of a stronger US Dollar and rising oil prices has lead to a rout of emerging market currencies as concerns over rising debt servicing costs spread.

- Month-end rebalancing may negatively impact the US Dollar as portfolio managers take profits after a strong performance in June.

- Sentiment for the US Dollar remains mixed despite the pullback in recent day.

For longer-term technical and fundamental analysis, and to view DailyFX analysts’ top trading ideas for 2018, check out the DailyFX Trading Guides page.

The US Dollar (via the DXY Index) ran up to its highest level of 2018 earlier today before turning back, more evidence that market participants are shifting their expectations over how a US-China trade war might unfold. Yesterday, the Trump administration changed tactics in one respect, but comments made from various administration officials have insisted that this is not a 'softening' in the negotation position.

Regardless of what route the Trump administration is pursuing, it seems that the Chinese government is deploying the Chinese Yuan's exchange rate as a policy tool. The onshore Yuan (USD/CNY) has gained ground in six consecutive sessions, while the offshore Yuan (USD/CNH) has now rallied for 11 straight days.

There has certainly been a spillover to other markets, with emerging market currencies getting hit hard across the board: the MSCI Emerging Market Currency Index is now at its lowest level since November 2017 (one notable currency in this basket, the Indian Rupee, just hit an all-time low versus the US Dollar).

The combination of a stronger US Dollar and rising oil prices has lead to concerns over rising debt servicing costs to spread: the Chinese Shanghai Composite is now in a bear market (down -22% from its yearly high) while the MSCI Emerging Index Fund is not far behind (down -18% from its yearly high).

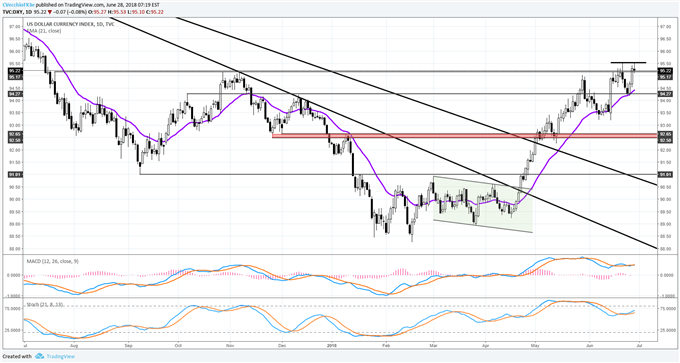

DXY Index Price Chart: Daily Timeframe (July 2017 to June 2018) (Chart 1)

All of these conditions point to a scenario in which the US Dollar can continue to squeeze higher in the near-term. That said, the DXY Index needs to pierce the daily bearish key reversal set last week at 95.53 before the green light is given once again to dollar bulls. Price kissed the high today but no break has been achieved yet.

Through the end of the week, the DXY Index may find trouble piercing its yearly high and highest level since July 2017 as the month and the quarter come to a close. Notably, the US Dollar has rallied enough during Q2'18 and June, particularly as US equity markets have faced choppy conditions, that rebalancing may yield profit taking in the greenback as portfolio managers shore up positioning in other asset classes that have underperformed.

Read more: US Dollar Gains Build as Trump Changes Tactics on Trade

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX