Talking Points:

- Markets have been quick to price in Fed hawkishness in the interim period since the last major FOMC meeting (with new SEPs) in September.

- US Dollar (via DXY Index) holding near 13-year highs, but further expectations curve steepening will be required to boost the greenback further.

- See the DailyFX Economic Calendar and see what live coverage for key event risk impacting FX markets is scheduled for next week on the DailyFX Webinar Calendar.

The December FOMC meeting seems merely procedural at this point. The Federal Reserve will hike its main rate to 0.50-0.75%, citing further tightness in the labor market and signs that inflation should rebound in 2017. The key for the US Dollar today, however, is to what degree of confidence the FOMC has in the US economy, or simply, 'how quickly does the Fed think it will be able to raise rates next?'

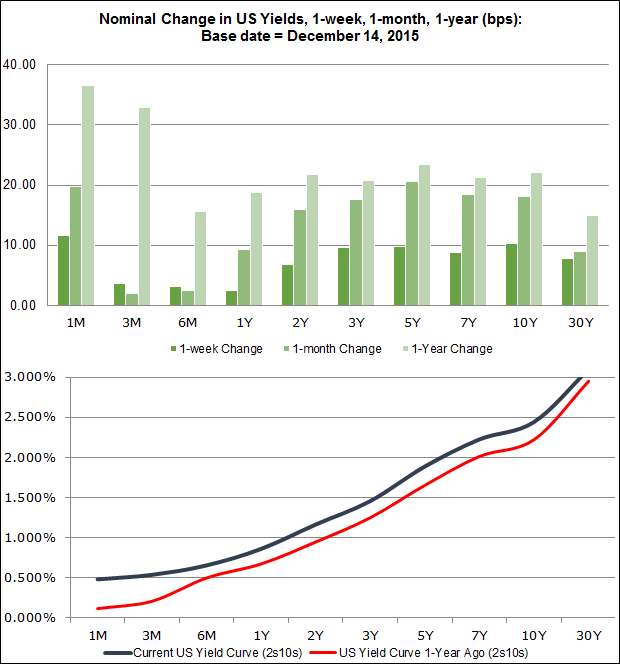

A quick look at Treasury rates shows how that traders are becoming more confident in the US economy. As a gauge of long-term growth and inflation expectations, the US Treasury yield curve has steepened on both the short- and long-ends over the past year (chart 1 below). The evolution of US economic data and politics over the past several months has, in investors' minds, increased the potential for tighter monetary policy in the near-term.

Chart 1: US Yield Curve (December 2015 versus Decmeber 2016)

The evolution of the US Treasury yield curve over the past year, but particularly how quickly rates have perked up over the past few months, has seen market expectations realign with the Fed's own forecasted rate path. Whereas at the September FOMC meeting, markets were pricing in one rate hike each of the next three years, now, markets are in line with what the Fed is poised to do in 2017, but may be a bit behind the Fed in 2018.

Chart 2: Fed Dot Plot Median Path and Overnight Index Swaps

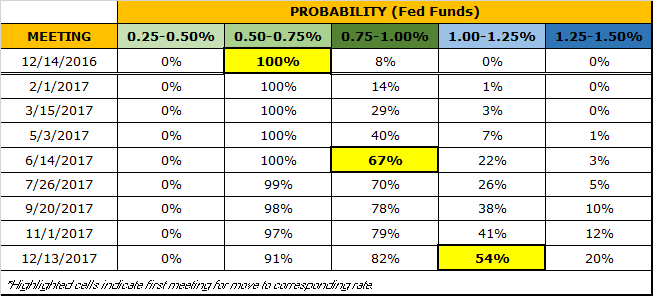

After the past few weeks of US economic data (especially after that the US Presidential elections), markets have been quick to pricing in June 2017 and December 2017 as when the Fed will raise rates next (table 1 below).

Table 1: Fed Rate Hike Expectations Through December 2017

Given the high expectations going into today's meeting, the FOMC will need to take on a rather hawkish stance in order to see the US Dollar rally significantly further. EUR/USD itself may be currently predisposed for lower prices (and USD/JPY for higher prices given interest rate differentials), but the FOMC meeting will only yield such a result of the Fed rate hike expectations curve steepens – a difficult scenario to envision seeing as how markets have already moved quite far already.

Read more: More Volatility Due for EUR/USD as Fed Hike Doesn’t Guarantee USD Gains

--- Written by Christopher Vecchio, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form