- USD/JPYreboundat approaching key inflection range at 110.30- risk for exhaustion

- Check out our 2018 USD/JPY projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

The Japanese Yen is weaker against all its major counterparts month-to-date with USD/JPY up nearly 2% off the May low. The rally is now testing confluence resistance and may cap further price advances in the near-term. Here are the USD/JPY levels that matter heading into the close of the week.

USD/JPY Daily Price Chart

Technical Outlook: In this week’s Technical Perspective on the Japanese Yen, we highlighted the USD/JPY price reversal off a key resistance range last month while noting that the advance was, “at risk in the medium-term while below 111.65. We can’t rule out another test of the highs but IF price is heading lower on this stretch, look for initial resistance at the 52-week / 200-day moving averages at ~110.15/30s.”

Price registered a high at 110.27 on building RSI divergence last night before pulling back- Its decision time. Look for daily support along the median-line backed by the monthly open at 108.80 with broader bullish invalidation down at the 2017 low-day close / 50% retracement at 107.84-108.01. A breach above this threshold targets the confluence resistance at the May high-day close / 61.8% retracement at 110.88-111.04 backed by 111.62.

New to Forex Trading? Get started with this Free Beginners Guide

USD/JPY 240min Price Chart

Notes: I’m working with a slightly different slope on the USD/JPY intraday chart, but the horizontal price targets are the same. Initial support rests at the median-line with a break below the weekly open at 109.45 needed to validate a near-term reversal targeting 108.94.

Why does the average trader lose? Avoid these Mistakes in your trading

Bottom line: The rebound off the May low is vulnerable here and IF price is heading lower, look for a daily close below 110.15. From a trading standpoint, I’ll favor fading strength against this zone near-term with a break below the weekly open needed to get things going. That said, given the technical considerations made earlier in the week on the US Dollar, we’ll respect a breach above this threshold with such a scenario eyeing targets into the upper parallel (111.60s). Keep in mind we have the FOMC and BoJ (Bank of Japan) interest rate decisions on tap next week- things are about to get very interesting for USD/JPY.

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

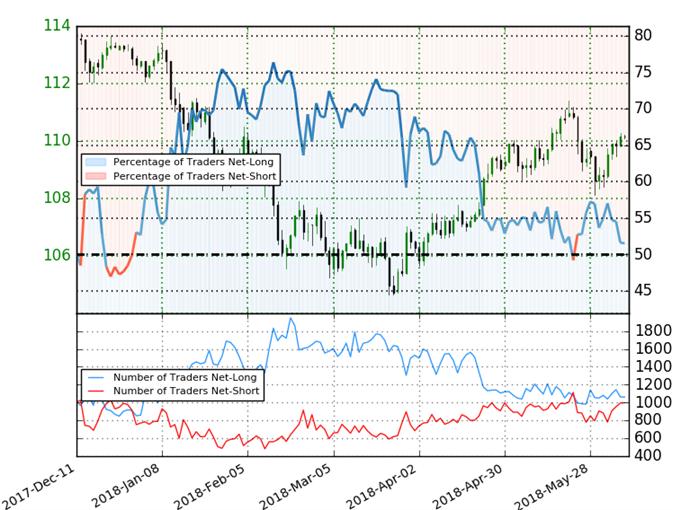

USD/JPY IG Client Positioning

- A summary of IG Client Sentiment shows traders are net-long USD/JPY- the ratio stands at +1.06 (51.6% of traders are long) – very weak bearishreading

- Retail traders have remained net-long since May 23rd; price has moved 0.1% higher since then

- Long positions are 3.4% lower than yesterday and 1.5% higher from last week

- Short positions are unchanged from yesterday and 10.5% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests USDJPY prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. From a sentiment standpoint, the recent changes in positioning warn that the current USDJPY price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in USD/JPY retail positioning are impacting trend- Learn more about sentiment!

---

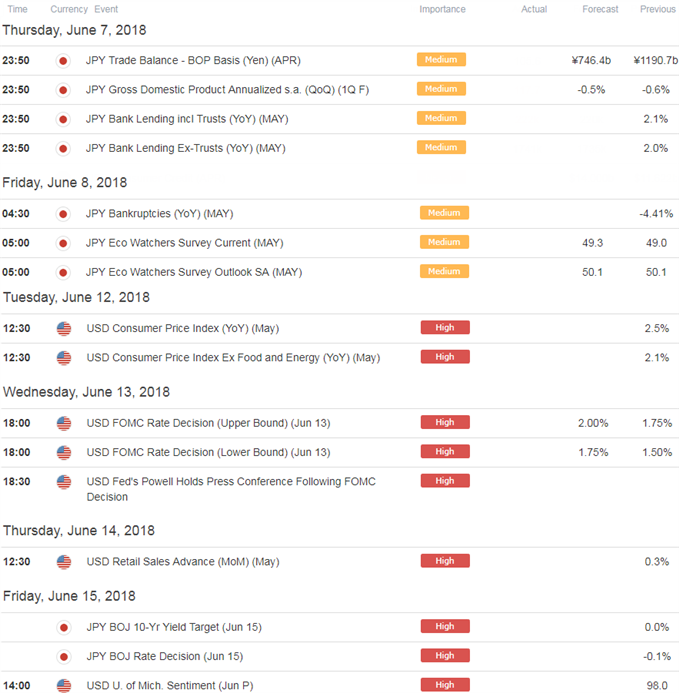

Relevant USD/JPY Data Releases

Economic Calendar - latest economic developments and upcoming event risk

Other Setups in Play

- GBP/USD Technical Outlook: Sterling Rebound Eyes Initial Resistance

- AUD/USD Technical Outlook: Aussie Rebound Testing Key Resistance Hurdle

- USD Threatens June Correction- Dollar Crosses in Focus (Webinar)

- US Dollar Technical Outlook: USD Flies to Fresh Yearly Highs

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com