To receive Michael’s analysis directly via email, please SIGN UP HERE

- Sterling sets monthly opening range above key support- Focus range is 1.3063–1.3221

- Check out our 4Q GBPUSD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: The British Pound has continued to trade just above slope support extending off the March low. We’ve been tracking this key support barrier in our Weekly Technical Outlook for months now and looking ahead the focus remains on a break of the monthly opening range which has taken shape just above.

IF cable is heading higher, prices must hold above 1.3020 (bullish invalidation) - a break below this threshold risks a drop into initial support at the 200-day moving average around ~1.2870. That said, daily resistance stands at 1.3272/83 with a breach above 1.3338 needed to mark resumption of the broader up-trend.

New to Forex? Get started with this Free Beginners Guide

GBP/USD 240min Chart

Notes: A closer look at price action further highlights this near-term consolidation just above slope support with basic trendline resistance off the September highs continuing to cap rebounds. Bottom line: the focus is on a break of the 1.3063 – 1.3221 range with a breach (favored) targeting 1.3338 backed by the 61.8% retracement at 1.3417.

A downside break puts us neutral with a close below 1.3020 needed to suggest a much larger breakdown is underway. Such a scenario targets initial support objectives at 1.2947 & 1.2870.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

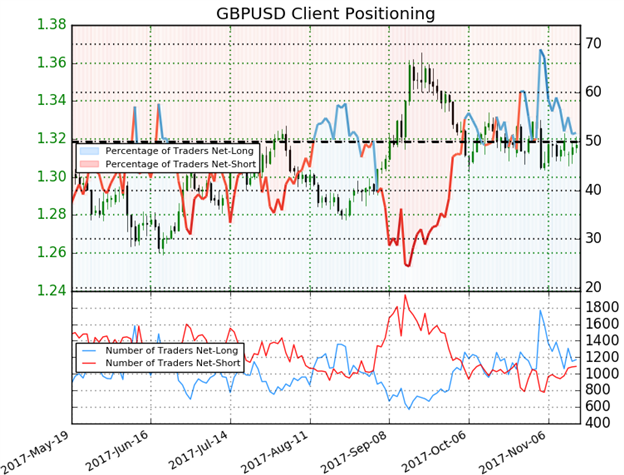

- A summary of IG Client Sentiment shows traders are net-long GBPUSD- the ratio stands at +1.07 (51.8% of traders are long) –weak bearishreading

- Retail has remained net-long since Nov 1st, price has moved 0.7% lower since then

- Long positions are 11.8% lower than yesterday and 11.5% lower from last week

- Short positions are 11.1% lower than yesterday but 3.3% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week and the recent changes in sentiment warn that the current GBPUSD price trend may soon reverse higher, despite the fact traders remain net-long.

See how shifts in GBP/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

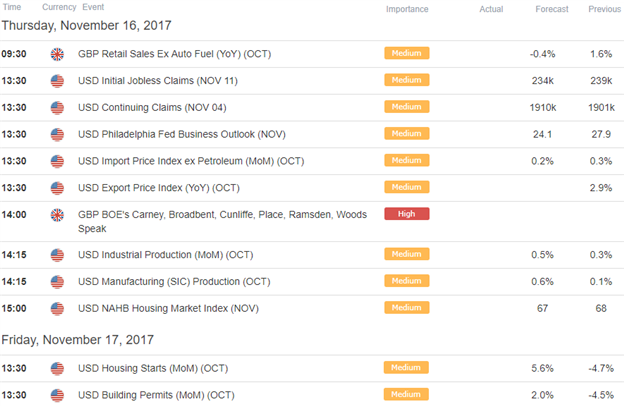

Relevant Data Releases

Why does the average trader lose? Avoid these Mistakes in your trading

Other Setups in Play

- U.S. Dollar Sell-off Targets Initial Support

- Ethereum Price Breakout Underway

- EUR/USD Responds to Initial Support- Recovery to Offer Opportunity

- Crude Oil Price Analysis- Breakout Targets to Know

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com