To receive Michael’s analysis directly via email, please SIGN UP HERE

- GBP/USD testing range highs ahead of major US/UK event risk

- Check out our 3Q GBP/USD projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

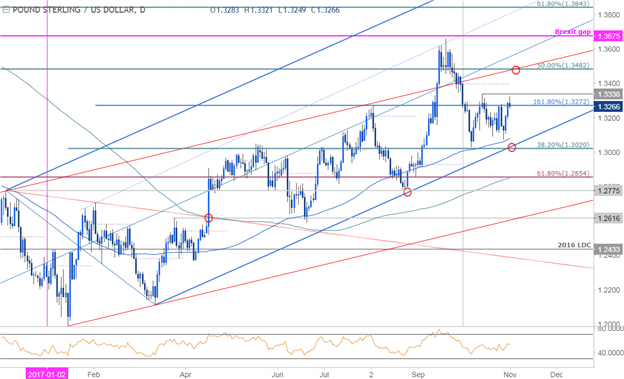

GBP/USD Daily Chart

Technical Outlook:This week’s Technical Perspective highlighted a constructive bias in cable while above the 1.3020 confluence support zone as price continues to trade within this broad median-line formation. Heading into majorevent risk over the next 72 hours the focus is on a break of the late-October range between 1.3020-1.3338. A downside break of this key range would invalidate the longer-term up-trend with such a scenario eyeing initial support objectives at 1.2854.

New to Forex? Get started with this Free Beginners Guide

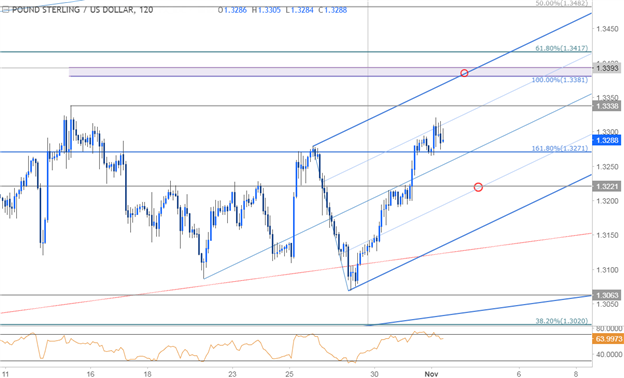

GBP/USD 120min Chart

Notes:A closer look at price action highlights a near-term ascending median-line formation extending off the late-October lows with price struggling just below the 50-line in early US trade. Note that we’ve been marking some divergence into this high and suggests the pair may be vulnerable for a near-term pullback. That said, the focus remains higher while within this formation heading into the open of November trade.

Interim support rests with the median-line (~1.3250) backed by 1.3221 – areas of interest for near-term exhaustion. A breach higher eyes subsequent resistance objectives at 1.3338 and 1.3381/93. A close above that threshold is needed to fuel the next leg higher targeting the 61.8% retracement at 1.3417 & 1.3482.

Why does the average trader lose? Avoid these Mistakes in your trading

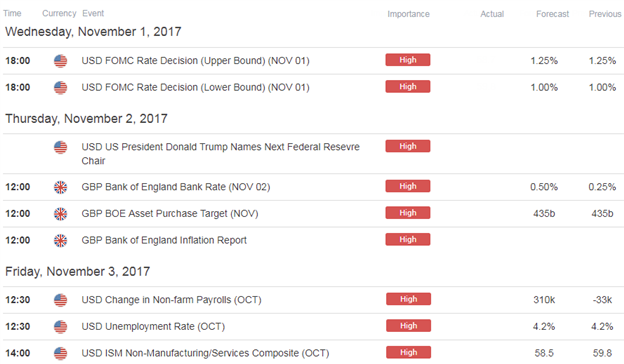

Bottom line: I’ll be looking for opportunities to fade weakness over the next few days. Keep in mind there is a ton of event risk on tap, starting with the FOMC later this afternoon. It’s Super Thursday in the UK tomorrow with the release of the BoE rate decision & the quarterly inflation report likely to fuel increased volatility in the Sterling crosses. Also note that we are waiting on President Trump’s pick for the new Fed Chair and the announcement is likely to drive USD price action as markets weigh the implications for the future path of monetary policy. We wrap-up the week with U.S. Non-Farm Payrolls on Friday- things are about to get very interesting.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

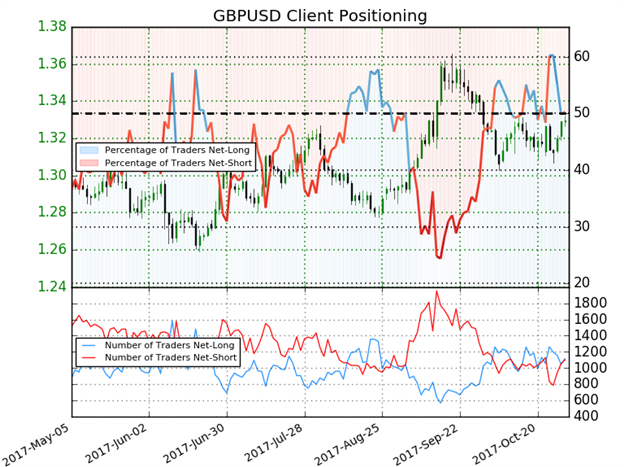

- A summary of IG Client Sentiment shows traders are net-long GBPUSD- the ratio stands at +1.01 (50.3% of traders are long) – Weak bearishreading

- Long positions are 13.4% lower than yesterday and 11.1% lower from last week

- Short positions are 7.1% higher than yesterday and 8.6% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week and recent changes in sentiment warn that the current GBPUSD price trend may soon reverse higher despite the fact traders remain net-long.

See how shifts in GBP/USD retail positioning are impacting trend- Click here to learn more about sentiment!

---

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- USD/CAD Eyes Resistance Ahead of FOMC, US & Canada Employment

- Weekly Technical Outlook: Stormy Seas Heading into BoE, FOMC & NFP

- EUR/JPY Plummets into Monthly Lows

- EUR/USD Flirts with Disaster as Post-ECB Selloff Targets Key Support

- Four-Day Losing Streak Breaks Aussie Down to Three-Month Lows

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.