To receive Michael’s analysis directly via email, please SIGN UP HERE

- EURJPY reversal targets monthly opening-range lows, focus is lower sub-133.48

- Check out our 3Q projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

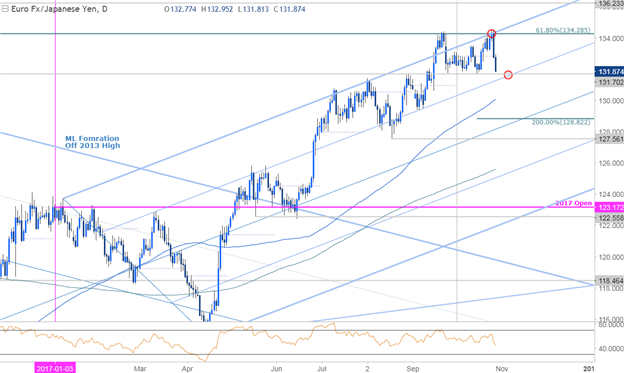

Technical Outlook: EURJPY turned from a key resistance confluence this week at 134.29- a level defined by the 61.8% retracement of the late-2014 decline, the September high-close and slope resistance. The subsequent decline has taken out the October open with price now approaching the monthly opening-range low at 131.70. Note that the 50-line of the ascending pitchfork rests just lower around ~131.20/30- a break below would suggest a more significant near-term high is in place with such a scenario targeting the 100-day moving average at ~130 and a measured move of the double top formation which converges at the median-line at 128.82.

New to Forex? Get started with this Free Beginners Guide

EUR/JPY 240min

Notes:A closer look at price action highlights a near-term descending pitchfork formation with the pair breaking below the median-line in overnight trade. The focus remains lower below this threshold with support initial support targets at 131.71 backed by the lower parallel (currently just above the 131-handle) and the 2016 open at 130.69.

Look for interim resistance along the median-line (currently ~132.60s) backed by 133.10. Broader bearish invalidation stands at 133.48. A topside breach above 134.29 would be needed to shift the focus higher targeting 136.23. Bottom line: from a trading standpoint, I’ll favor selling rallies while within this formation targeting a break of the monthly opening rage lows.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

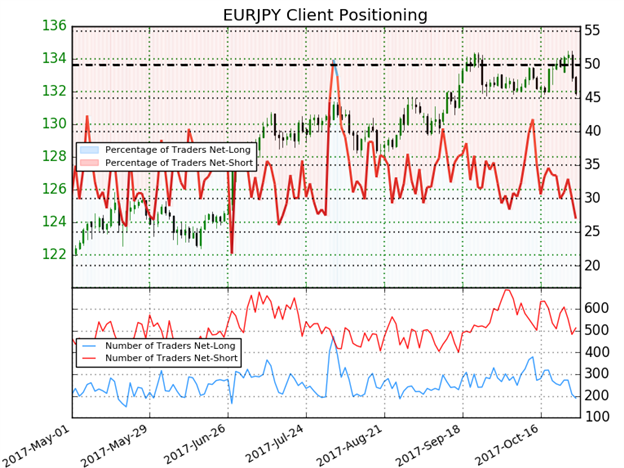

- A summary of IG Client Sentiment shows traders are net-short EURJPY- the ratio stands at -2.7 (27.0% of traders are long) – Weak bullishreading

- Retailhas remained net-short since Aug 4th; price has moved 1.8% higher since then

- The percentage of traders net-long is now its lowest since Jul 13 - EURJPY was near 129.179

- Long positions are 38.3% lower than yesterday and 37.9% lower from last week

- Short positions are 11.2% lower than yesterday and 4.3% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURJPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURJPY-bullish contrarian trading bias.

- That said, sentiment is now stretching into extremes and does leave the pair vulnerable near-term as price tests a break of key support.

See how shifts in EUR/JPY retail positioning are impacting trend- Click here to learn more about sentiment!

---

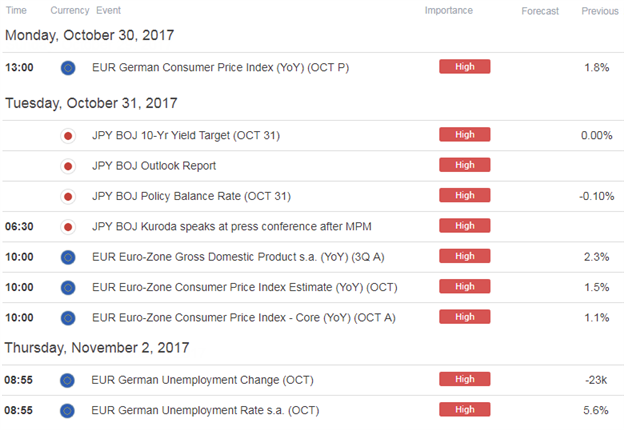

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- EUR/USD Flirts with Disaster as Post-ECB Selloff Targets Key Support

- Four-Day Losing Streak Breaks Aussie Down to Three-Month Lows

- Ethereum Prices Settle on Fibonacci Support

- Weekly Technical Outlook: USD Turn or Burn at Key Resistance

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.