To receive Michael’s analysis directly via email, please SIGN UP HERE

- ETHUSD rally approaches initial resistance levels- Constructive while above 270

- Check out our new quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

ETH/USD Daily Chart

Technical Outlook: Ethereum prices are up nearly 50% off the September lows with advance now testing near-term resistance today at 61.8% ext at 312. While we could see some more kickback from here, the focus remains higher while above 271/74- a region defined by the 100-day moving average and the 7/18 swing high. Note that daily momentum has remained below 60 and we’ll be looking for a move higher to confirm a more significant low is in place.

New to Forex? Get started with this Free Beginners Guide

ETH/USD 240min

Notes:A closer look at near-term price action shows Ethereum trading within the confines of a modified ascending median-line formation extending off the monthly lows. Prices reversed off confluence resistance today at 312 with interim support now eyed at 285. A break below 271 would be needed to shift the focus lower with such a scenario targeting 252 & key support back at 234.

A breach higher targets the 61.8% retracement at 321- note that this threshold converges on the median-line heading into the close of the month. Bottom line, from a trading standpoint we’ll favor buying pullbacks while within this formation with a breach above the median-line needed to fuel the next leg higher in Ethereum prices. Subsequent resistance targets are eyed at 350/55backed by the record high-day close at 385.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

---

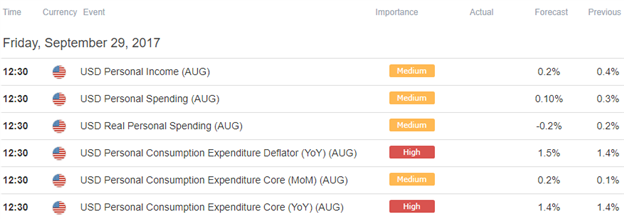

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- USD/CAD Rally Eyes Key Resistance Targets

- AUD/USD Sell-Off Approaching Key Support Hurdle

- Euro, Pound and JPY: Weekly Strategy Outlook

- Bitcoin Prices Under Pressure- Time to Buy?

- NZD/USD Testing Key Resistance Barrier Ahead of FOMC, New Zealand GDP

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.