To receive Michael’s analysis directly via email, please SIGN UP HERE

- The delcine is approaching technial support into the 1.27 region- shorts at risk into this level

- Check out our GBPUSD quarterly projections in our Free DailyFX Trading Forecasts

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: Last week we highlighted that ‘GBP/USD has been trading within the confines of an ascending pitchfork formation dating back to last year with an outside-day reversal at the highs shifting our focus lower earlier this month. Prices broke below slope support today with the decline now testing the 61.8% retracement at 1.2850.’

Prices sat on that level into the close of the week with a break yesterday now targeting more significant structural support at the December high / lower parallel at 1.2760/75- a level of interest for possible exhaustion. A break below this threshold would risk a drop towards the 200-day moving average / 50% retracement at 1.2628/45.

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here !

GBP/USD 120min

Notes: A closer look at price action shows cable trading within an embedded descending channel with the upper parallel converging on the weekly open at 1.2867-a breach above this region would be needed to mark a near-term reversal in the pair with such a scenario eying initial targets at1.2949.

That said, the immediate risk is lower and from a trading standpoint, I would be looking for a dip into the lower parallel for possible exhaustion / long-entries. A break below 1.27 would suggest the larger construct has been compromised and would keep the broader downside bias in play targeting 1.2641 & 1.2616.

New to Forex? Get started with this Free Beginners Guide

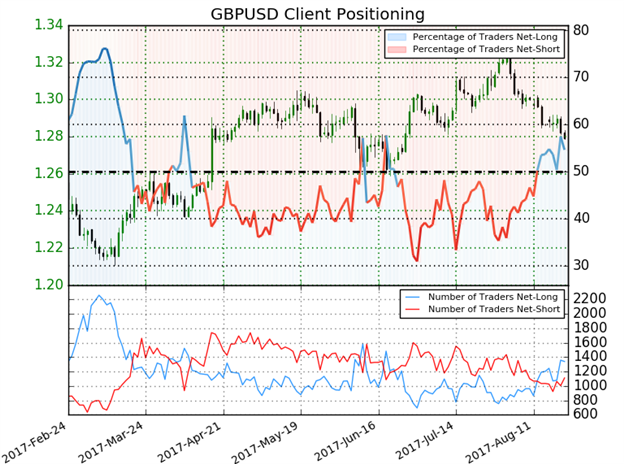

- A summary of IG Client Sentiment shows traders are net-long GBPUSD- the ratio stands at +1.21 (54.7% of traders are long) – weak bearish reading

- Long positions are 8.9% higher than yesterday and 9.1% higher from last week

- Short positions are 8.6% higher than yesterday and 2.3% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBPUSD-bearish contrarian trading bias.

See how shifts in British Pound retail positioning are impacting trend- Click here to learn more about sentiment!

---

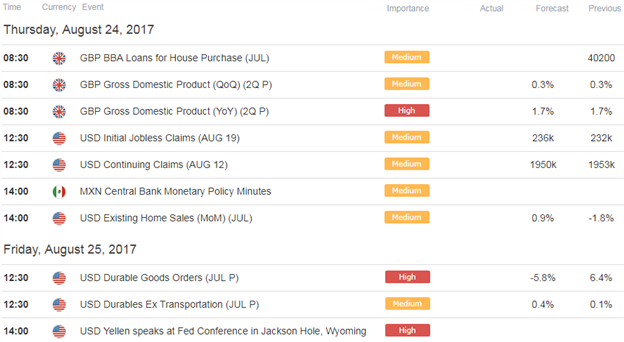

Relevant Data Releases

Check out this week’s DailyFX Webinar Schedule

Other Setups in Play

- EUR/USD: Levels to Know for Jackson Hole

- Webinar: FX Markets Brace for Yellen - Ethereum Breakout Accelerates

- Are Gold Prices on the Verge of Fresh Yearly Highs?

- AUD/USD Bull-Flag Breakout in the Works

- Written by Michael Boutros, Currency Strategist with DailyFX Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.