To receive Michael’s analysis directly via email, please SIGN UP HERE

- GBPJPY testing resistance ahead of major event risk- broader outlook remains constructive

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: We visited GBPJPY last week as prices were approaching this slope line originating off the August 2015 highs with the pair once again testing this region ahead of the Bank of England’s (BOE) ‘Super Thursday’ event. A breach above this zone targets critical resistance at 147.86-148.42 – a region defined by the 2016 high-day close and the December 2016 high. Daily support is rests at 144.30 with broader bullish invalidation steady at 142.15.

Learn more about Pitchfork & Median-line formations in Michael’s three-part trading series

GBP/JPY 120min Chart

Notes: GBPJPY broke above downslope resistance this week with the rally stretching into the 146.73 targets before reversing sharply in early U.S. trade. Heading into ‘Super Thursday’ the focus remains higher while above former parallel resistance (blue) with interim support seen here at 145.90.

Initial resistance is eyed at 146.34/39 with a breach above highlighted region at the weekly highs needed to mark resumption of the broader uptrend. Such a scenario targets subsequent resistance objectives at 146.97, 147.35 & critical resistance at 147.86-148.42.

From a trading standpoint I’ll favor fading weakness while above 145.39 with a breach of the highs likely to see accelerated gains for the pair. Added caution is warranted heading into the interest rate decision and the quarterly inflation report with the releases likely to fuel increased volatile in the sterling crosses.

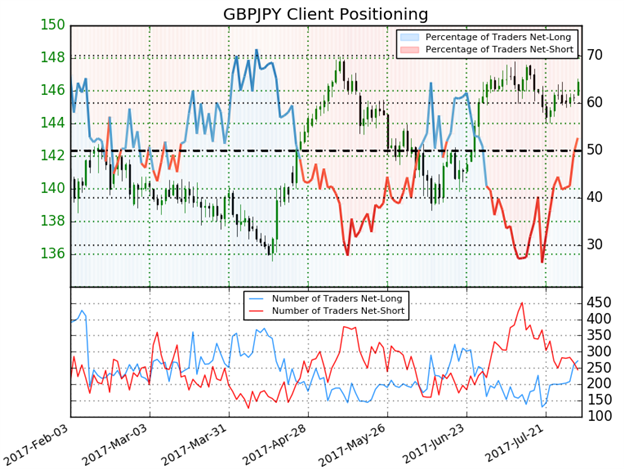

- A summary of IG Client Sentiment shows traders are net-long GBP/JPY- the ratio stands at +1.11 (52.6% of traders are long) – weak bearishreading

- Long positions are 10.5% lower than yesterday but 7.9% higher from last week

- Short positions are 10.9% lower than yesterday and 21.7% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPJPY prices may fall. That said, retail is further net-long than yesterday and last week and the combination of current positioning and recent changes gives us a GBPJPY-bearish contrarian trading bias from a sentiment standpoint. Look for a build in short exposure to offer further conviction in the event of a breakout.

What to look for in GBP/JPY retail positioning - Click here to learn more about sentiment!

---

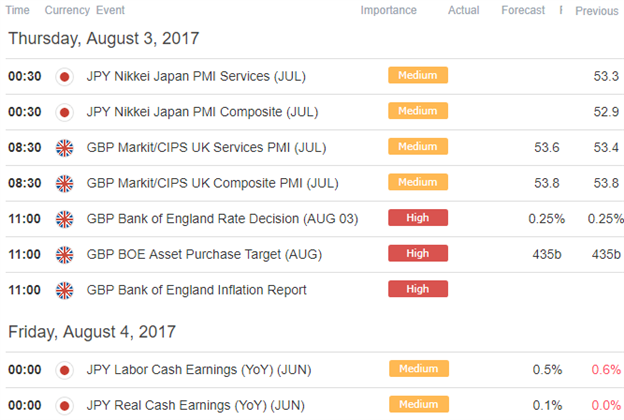

Relevant Data Releases

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- EUR/USD Rally Vulnerable Ahead of NFP- Pullback to Offer Opportunity

- Webinar: USD at the Lows Ahead of the July Close- When Will the Pain End?

- Cryptocurrency Analysis: Bitcoin, Ethereum Prices Plunge into Support

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.