To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- Bitcoin looks to validate breakout, Ethereum prices consolidate into resistance

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Bitcoin (BTC/USD) 240min Chart

Technical Outlook: The price of Bitcoin plummeted today, breaking a near-term consolidation range that has held since the July 20th high. The decline is now approaching initial support at the confluence of former median-line resistance (blue) & the 38.2% retracement of the July advance at 2514. IF last week’s breakout is legit, price should hold above this region today.

A break lower targets the July open at 2465 and the Fibonacci confluence at 2384-2405- both these zones represent areas of interest for near-term exhaustion / long-entries. Resistance stands at 2639 with a breach above 2667-2700 needed to shift the broader focus back to the long-side in Bitcoin.

Ethereum (ETH/USD) 240min Chart

Technical Outlook: Ethereum is in a slightly different position here with prices continuing to hold within the confines of the larger descending pitchfork formation extending off the record highs registered in June. An ascending structure off the monthly lows highlights near-term confluence support here at 203. If Ethereum is indeed heading higher, price should hold above 187 (bullish invalidation). A breach above 236 is needed to shift the broader focus higher with such a scenario targeting subsequent resistance objectives into the upper parallel / 50% retracement at 270.

Learn more about Pitchfork formations in Michael’s three-part trading series

---

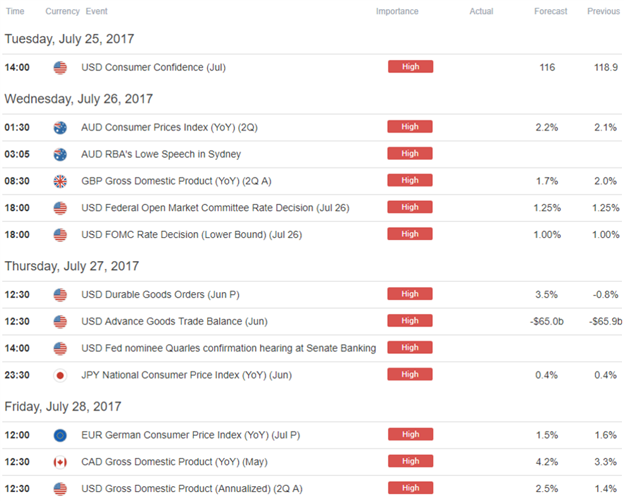

Relevant Data Releases

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- EUR/JPY: Continuation or Correction- Range Break to Offer Opportunity

- Strategy Webinar: Markets at Risk for Trend Exhaustion Ahead of FOMC, U.S. GDP

- ECB Preview- EUR/USD Rally Faces Moment of Truth

- GBP/USD Rejected at Resistance- Price Constructive Above 1.2890

- AUD/JPY Rallies to Fresh Yearly Highs – Initial 2017 Targets in View

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.