To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- Euro rally at risk sub-1.1876- broader outlook remains constructive

- Check out our New 3Q EUR/USD projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

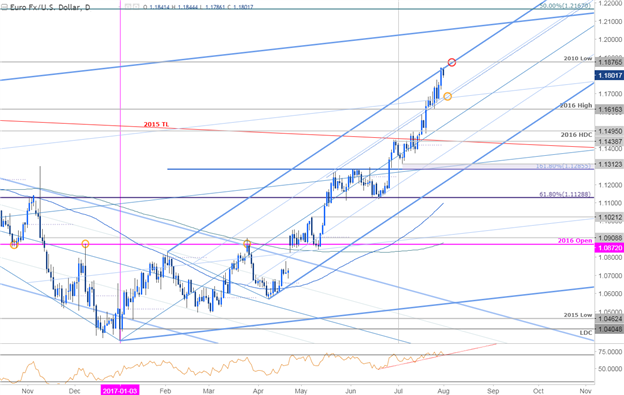

EUR/USD Daily Chart

Technical Outlook: Euro stretched into the pitchfork resistance yesterday, capping the weekly advance near-term. The 2010 low comes in just higher at 1.1876- the long-bias is at risk heading into these levels and we’re on the lookout for possible near-term exhaustion into the August open.

Interim support rests along the 75% line around (currently ~1.17) with broader bullish invalidation steady at the 2016 high-day close at 1.1495. In the event of a topside breach, look for resistance targets at the longer-term median-line extending off the February highs (currently ~1.2040) backed by 1.2167.

Learn more about Pitchfork & Median-line formations in Michael’s three-part trading series

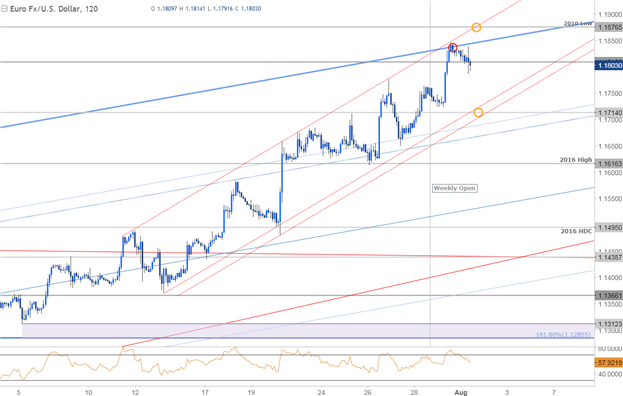

EUR/USD 120min Chart

Notes: An embedded ascending channel off the 7/13 low further highlights the aforementioned resistance levels with immediate support eyed at last week’s high at 1.1777 backed by 1.1714. A break below the figure is needed to suggest a larger correction is underway targeting 1.1616 & the median-line (currently ~1.1540).

Keep in mind we still have the release of U.S. Non-Farm Payrolls (NFP) on Friday which could offer a good deal of volatility in the USD crosses. From a trading standpoint, I’m looking for near-term exhaustion up here but ultimately, we’d be looking for long-entries on a more meaningful pullback into structural support.

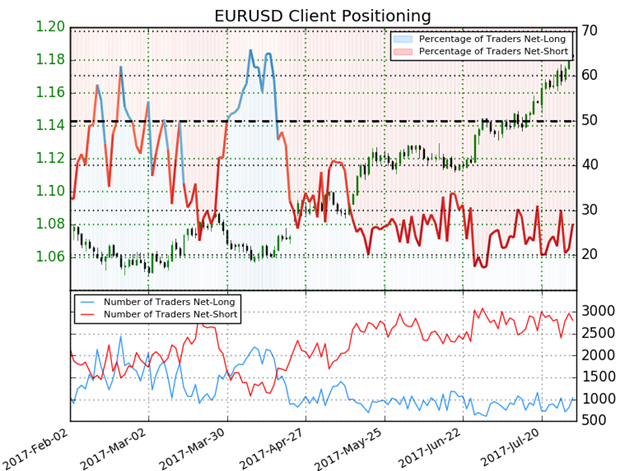

- A summary of IG Client Sentiment shows traders are net-short EUR/USD- the ratio stands at -2.7 (27.0% of traders are long) – bullishreading

- Retail traders have been net-short since April 18th- Price has moved 10.6% higher since then

- Long positions are 12.0% higher than yesterday and 3.2% higher from last week

- Short positions are 4.8% lower from yesterday and 7.9% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EURUSD prices may continue to rally. That said, retailless net-short than yesterday and compared with last week and the combination of current positioning and recent changes warn that the current Euro price trend may soon reverse lower despite the fact traders remains net-short.

What to look for in EUR/USD retail positioning - Click here to learn more about sentiment!

---

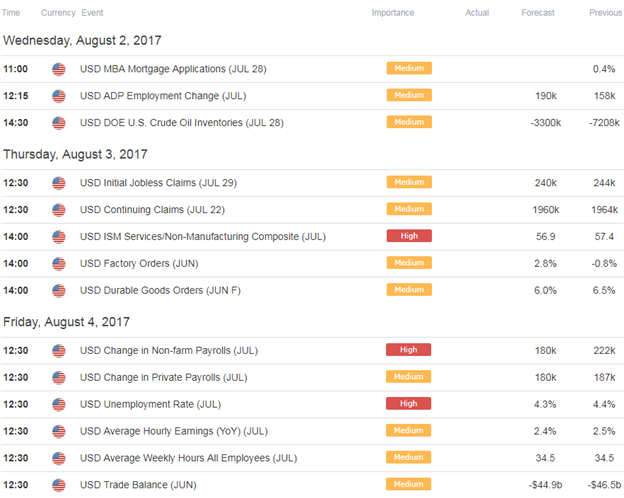

Relevant Data Releases

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- Webinar: USD at the Lows Ahead of the July Close- When Will the Pain End?

- GBP/JPY Rally Approaching Resistance- Breakout Pending

- Cryptocurrency Analysis: Bitcoin, Ethereum Prices Plunge into Support

- EUR/JPY: Continuation or Correction- Range Break to Offer Opportunity

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.