To receive Michael’s analysis directly via email, please SIGN UP HERE

Talking Points

- GBP/JPYthreatens near-term breakout- broader outlook constructive

- Check out our New 3Q projections in our Free DailyFX Trading Forecasts.

- Join Michael for Live Weekly Strategy Webinars on Mondays at 12:30GMT

Technical Outlook: The rally in GBP/JPY has been capped by a long-term trendline extending off the August 2015 highs with the pullback rebounding off the 38.2% retracement this week at 144.30. The focus is on this range heading into the close of the month but bottom line: price is approaching down-trend resistance and a breach / close above would risk a larger-scale breakout play in the pair.

If we break lower, look for a correction towards confluence support at 142.15/40 (region of interest for long-entries & broader bullish invalidation). A topside breach (favored) targets the 2016 high-day close at 147.86 backed closely by the December 2016 high at 148.43- a rally surpassing this level would be needed to validate a more meaningful breakout targeting 151.97.

Learn more about Pitchfork formations in Michael’s three-part trading series

GBP/JPY 120min Chart

Notes: A closer look at price action shows the GBP/JPY trading within the confines of a near-term descending pitchfork extending off the monthly highs with price approaching the upper median-line parallel today in New York trade. This level converges on the 61.8% retracement at 146.34 and could offer some near-term resistance on this immediate advance.

Interim support rests at 145.39 with our focus weighted to the topside while above the lower parallel / 144.70. A breach above 146.73 (December 19th reversal-day close) is needed to validate the near-term breakout targeting 147.86. Added caution is warranted heading into Japanese inflation data into the close of the week with the release likely to fuel increased volatility in Yen crosses.

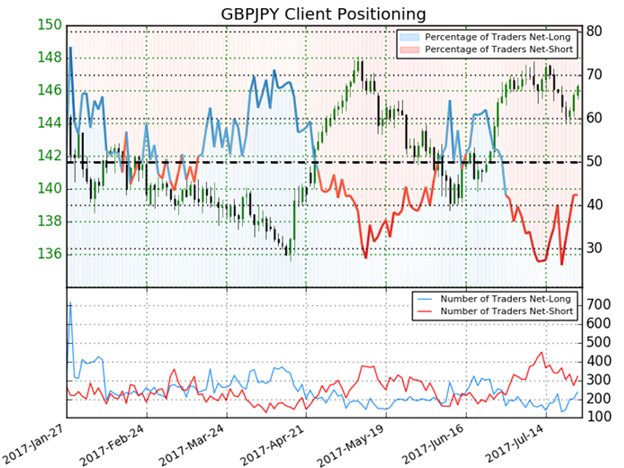

- A summary of IG Client Sentiment shows traders are net-short GBP/JPY- the ratio stands at -1.35 01 (42.5% of traders are long) – weak bullish reading

- Retail has been net-short since June 30th- Price has moved 1.7% higher since

- Long positions are 0.4% lower than yesterday but 24.1% higher from last week

- Short positions are unchanged from yesterday and 17.1% lower from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/JPY prices may continue to rise. That said, retail is more net-short than yesterday but less net-short from last week and the combination of current positioning and recent changes gives us a further mixed near-term trading bias from a sentiment standpoint.

What to look for in GBP/JPY retail positioning - Click here to learn more about sentiment!

---

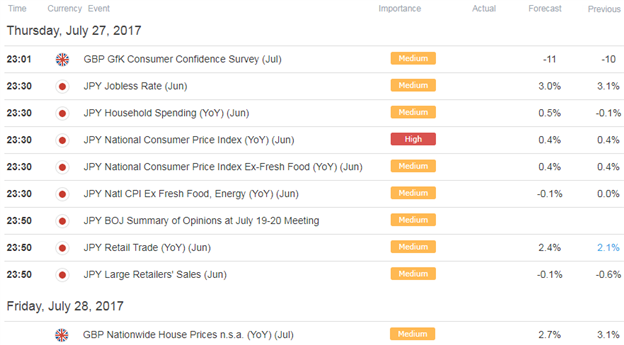

Relevant Data Releases

Join Michael on Friday for his bi-weekly Live Webinar on the Foundations of Technical Analysis- Register for Free Here!

Other Setups in Play:

- Cryptocurrency Analysis: Bitcoin, Ethereum Prices Plunge into Support

- EUR/JPY: Continuation or Correction- Range Break to Offer Opportunity

- Strategy Webinar: Markets at Risk for Trend Exhaustion Ahead of FOMC, U.S. GDP

- ECB Preview- EUR/USD Rally Faces Moment of Truth

- GBP/USD Rejected at Resistance- Price Constructive Above 1.2890

- Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michael on Twitter @MBForex or contact him at mboutros@dailyfx.com.