Talking Points

- USD/CAD approaching initial support- Shorts at risk above yearly open

- Updated targets & invalidation levels

USDCAD 30min

Chart prepared by Michael Boutros

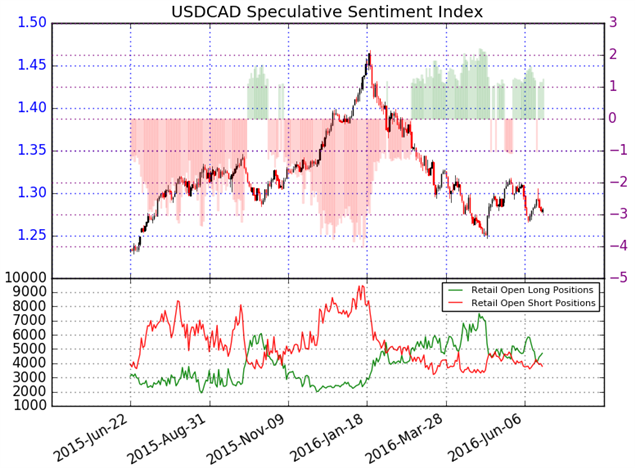

Technical Outlook: We’ve been tacking this USDCAD setup on SB Trade Desk for the past few weeks with the decline now approaching more significant technical support targets. Heading into the release of Canada retail sales tomorrow, look for initial support 1.2749/55 backed by the 2016 low-day close at 1.2722. A break sub-1.2990 would be needed to keep the short-bias in play.

From a trading standpoint, I would be looking for an exhaustion low / long-entries on a move into these targets with topside resistance objectives eyed at 1.2818, 1.2885, 1.2923 and 1.2961/65- a region defined by the 6/16 high-day close & the 61.8% retracement. Keep in mind we also have the second day of the Fed’s semi-annual Humphrey Hawkins testimony before congress which could spur added volatility in the USD crosses. Continue tracking this setup and more throughout the week- Subscribe to SB Trade Desk and take advantage of the DailyFX New Subscriber Discount.

Avoid the pitfalls of near-term trading strategies by steering clear of classic mistakes. Review these principles in the "Traits of SuccessfulTraders” series.

- A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net long AUDUSD- the ratio stands at +1.23(55% of traders are long)-weak bearishreading

- Yesterday the ratio was +1.18; Long positions are 2.6% higher than yesterday and 4% below levels seen last week

- Traders have flipped from net long to net short twice already this month- Extreme of 1.613 registered the day after the low on 6/8.

- Open interest is 0.4% higher than yesterday and 4.7% below its monthly average. Although SSI metrics put a bearish tone on the pair, the pair is coming into key technical support targets at the monthly & yearly low-day closes – leaves the short-side vulnerable while above these levels

Help fine-tune you entries, click here to learn more about the DailyFX Grid Sight Index (GSI)

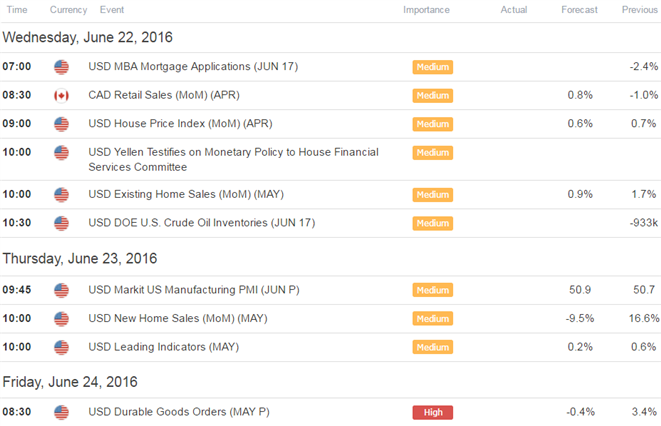

Relevant Data Releases This Week

Other Setups in Play:

- AUD/USD: RBA Minutes, Fed Testimony to Offer Long Entries

- Webinar: Brexit Play Book- GBP to Come in Focus Post Fed Testimony

- EUR/USD: Breach of Weekly High to Fuel Reversal From Monthly Open

- AUD/USD Post-FOMC Rebound Looks to AU Employment, US CPI for Fuel

- FOMC Game Plan - EUR/USD Constructive Above Monthly Open at 1.1128

Looking for more trade ideas? Review DailyFX’s Top Trading Opportunity of 2016

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFX and Tuesday, Wednesday & Thursday’s on SB Trade Desk at 12:30 GMT (8:30ET)