Gold, XAU/USD, Market Volatility, Omicron, NFP, US Jobless Claims – Talking Points

- Gold prices see small bounce as Omicron stokes volatility across markets

- Falling US breakeven rates may keep bullion from extending higher

- US jobless claims may provide last data point prior to non-farm payrolls

Gold caught a bid overnight amid a pickup in market volatility. XAU/USD was up over 1% overnight before giving back some gains into the Asia-Pacific trading hours. The volatile Wall Street session gave bullion prices a bid on safe-haven flows despite some US Dollar strength. Investors were spooked by news that the Omicron variant was identified in the United States.

The S&P 500’s VIX ‘fear gauge’ hit its highest level since February at 32.61 before easing this morning. Gold prices typically do well when volatility picks up as traders move to hedge losses elsewhere in their portfolios. Still, XAU/USD remains near its lowest levels since early November after prices fell sharply in recent weeks.

Those losses are likely attributable to the Federal Reserve and its increasingly hawkish posturing on interest rates. Traders began pricing in more aggressive rate hike bets through November. The CME Group’s FedWatch Tool is pricing a 21.8% chance for a 50 basis point hike at the June 2022 FOMC meeting, up from 17.8% just a month ago.

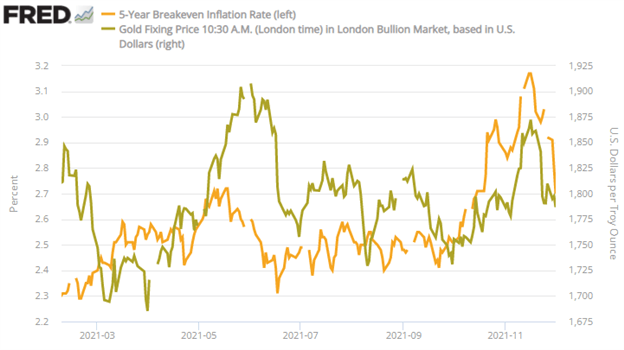

The market’s view of the US central bank’s course has tamped down on inflation expectations, evidenced by a drop in the 5- and 10-year breakeven rates. A breakeven rate is the gap between an inflation-indexed Treasury yield and the nominal yield of the same tenure and is used as a forward indicator of inflation. Gold prices sometimes move closely with US breakeven rates due to the asset’s appeal as an inflation hedge.

Given the yellow metal’s sensitivity to inflation expectations and Fed rate hike bets, the United States non-farm payrolls report for November due out later this week may provide the next directional cue for prices. Analysts expect to see 545k jobs added last month in the US, according to a Bloomberg survey. That would signify robust strength in the labor market and likely driver rate hike bets higher, to XAU’s detriment. A better-than-expected print, even more so.

Tonight will bring initial jobless claims across the wires, with 240k expected for the week ending November 27. That will be the last data print before Friday’s NFP report. That could sway NFP estimates, which could, in turn, affect gold prices. Again, a better-than-expected reading would bode poorly for bullion prices.

Source: fred.stlouisfed.org

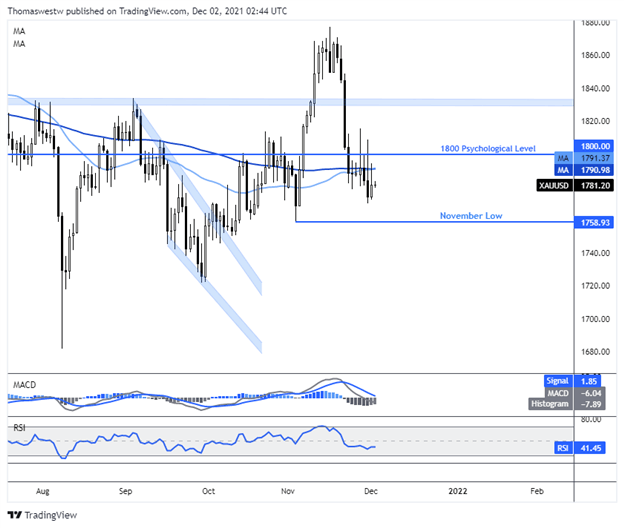

Gold Technical Forecast

Prices are nearly unchanged through the first half of the APAC trading session, with bulls failing to extend the overnight strength. While the 50-day Simple Moving Average (SMA) did cross above the 200-day SMA overnight, the signal is unlikely to stoke any confidence considering the large drop in recent weeks. If prices do move higher, the 1800 psychological level is a likely spot of resistance. Alternatively, the November low is an eyed area of support at 1758.93.

Gold Daily Chart

Chart created with TradingView

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter