CRUDE OIL OUTLOOK:

- Crude oil prices little-changed as OPEC+ strikes output increase deal

- Supply rise implications seemingly offset by structural stability promise

- Risk-off sentiment swing may bring pressure, chart setup favors losses

Crude oil prices shrugged as OPEC+ officials managed to overcome weeks of acrimony and agree on a joint plan to boost production. The cartel of top oil exporters and its allies have struggled to find common ground for weeks, with a dispute between Saudi Arabia and the UAE seeming to be the main sticking point.

Now, a bargain has been struck that will see output increase by 400k barrels per day each month starting from August until full capacity has been restored. This means that by the end of the year, OPEC+ will have ramped up to deliver a further 2 million barrels per day each month.

The scheme is meant to run until all of the group’s 5.8 million barrels per day in halted production are restored. If the current pace is maintained, that lands sometime in September-October of next year. It may yet be altered. OPEC+ officials will continue to meet monthly to review the program.

As it stands, the news seems to have left crude oil traders without a clear directional lead. At surface level, the boost in supply might have pressured prices lower. Achieving agreement defused the threat of a production free-for-all in the event that OPEC+ collapsed however, offering a measure of support.

From here, a dearth of schedule event risk seems likely to put broader market sentiment trends in the driver’s seat. That seems to be tuned to a “risk-off” setting, which usually bodes ill for oil prices. Weakness has been mild so far, but selling may yet gather steam as markets in Europe and the US join the fray.

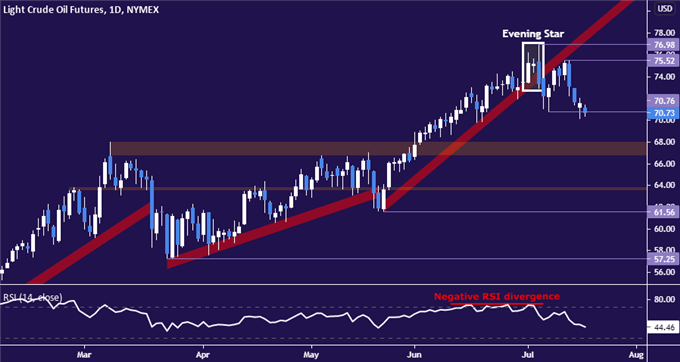

CRUDE OIL TECHNICAL ANALYSIS

The WTI benchmark continues to probe swing-low support at 70.76 after appearing to mark a top below the $77/bbl figure with the appearance of a bearish Evening Star candlestick pattern. A daily close under this barrier may expose the 66.76-67.98 zone. Immediate resistance is in the 75.52-76.98 area. Reclaiming a foothold above that seems like a prerequisite for neutralizing near-term selling pressure.

Crude oil price chart created using TradingView

CRUDE OIL TRADING RESOURCES

- What is your trading personality? Take our quiz to find out

- See our guide to build confidence in your trading strategy

- Join a free live webinar and have your questions answered

--- Written by Ilya Spivak, Head Strategist, APAC for DailyFX

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter