Gold, XAU/USD, Fed, 10-Year Treasury Yield, Technical Analysis - Talking Points:

- Gold prices weaken as 10-year Treasury yield trims last week’s loss

- Focus turns to US retail sales and PPI data before the Fed later on

- XAU/USD may be vulnerable to a top if trendline breakout continues

Anti-fiat gold prices weakened over the past 24 hours as financial markets took a very different approach from what was witnessed this past week. After the worst weekly performance for the 10-year Treasury yield in about 6 months, bond rates shot higher to start markets off on Monday. This also offered some upward momentum to the US Dollar.

Both bond rates and the Greenback moving higher can open the door to a volatile session for the yellow metal. That is because gold is a non-interest-bearing asset that is primarily priced in US Dollars across the globe. It seemed that traders unwound some dovish expectations for the Federal Reserve ahead of this week’s FOMC monetary policy announcement.

There, investors will be closely tuning in for the central bank’s projections on the long-run path for interest rates and policy tapering. This is amid recent elevated measures of inflation, where core price growth accelerated at the fastest pace in almost 30 years. Albeit, a low-base effect is likely distorting some of the readings, with the price of used vehicles being a key driver of CPI last month.

Looking into the remaining 24 hours, gold may continue to consolidate just under May highs as investors await this week’s highly anticipated Fed rate decision. The US will release figures for retail sales and wholesale inflation (PPI). But, the close proximity of the Fed could mean that lasting follow-through may have to wait until this event risk passes.

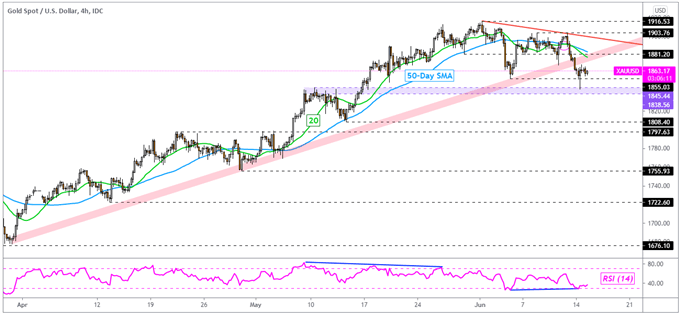

Gold Technical Analysis

XAU/USD may be at risk to a deeper turn lower if prices can clear immediate support around 1855. That is because the yellow metal closed under rising support from the beginning of April. A bearish crossover also occurred between the 20-day and 50-day Simple Moving Averages (SMAs). But, positive RSI divergence shows that downside momentum seems to be fading. That can precede a turn higher.

XAU/USD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter