Gold, XAU/USD, Fed, Powell, Technical Forecast – Talking Points

- March FOMC meeting calmed market fears about premature tightening, sending gold higher

- US Dollar deflates after Chair Powell assuages markets despite optimistic economic projections

- Technical bounce may carry momentum forward through week-end after crossing 20-day SMA

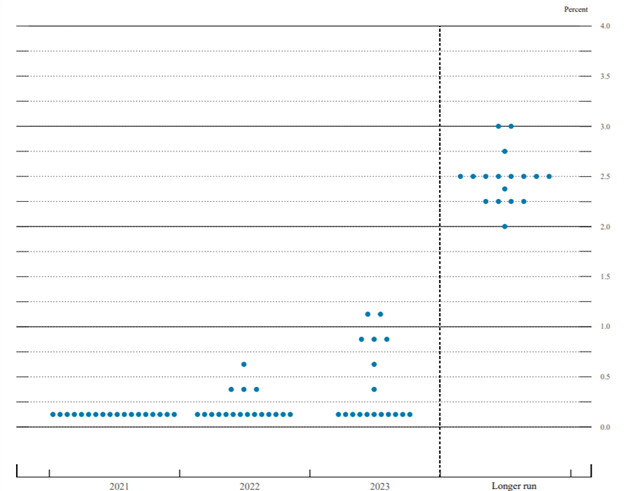

Gold surged higher against the Greenback after the Federal Reserve’s March interest rate decision calmed fears about untimely rate tightening. While the Fed’s dot plot — which tracks Fed officials’ rate projections through 2023 and beyond—saw a handful of members shift their projections up, Chair Powell once again assuaged markets about the central bank’s accommodative path.

Treasury yields and breakeven inflation rates have been drifting higher as the global economic recovery continues to strengthen. The 10-year rate moved higher on the day but came well off its intraday high. One scenario that XAU bulls may be banking on is a Fed that sees any real rise in inflation as transitory and instead focuses entirely on the labor market while sticking to the dovish outlook on rates.

Assuming that mindset would stay consistent within the Fed amid an even stronger economic backdrop, it would allow inflation to run beyond the target for some time while the labor market's slack dissipates. Granted, that is within the Fed’s current averageinflation targeting (AIT) regime. However, it would also need to be coupled with its current pseudo-objective of constantly reassuring markets, which is already being done.

A scenario like that could cap US Dollar upside and in turn allow gold prices to rise, even alongside a market that is bearish on Treasury securities. In this scenario, USD is likely to continue taking its cues from risk appetite in the broader equity markets. Mr. Powell was able to calm markets with his dovish commentary despite robust upgrades in the Summary of Economic Projections (SEP), but the Fed Chair walks a fine line between the policy outlook and the current economic backdrop. A miscalculation by the world’s most powerful central banker threatens its credibility with markets.

Source: Federalreserve.gov

Gold Technical Forecast

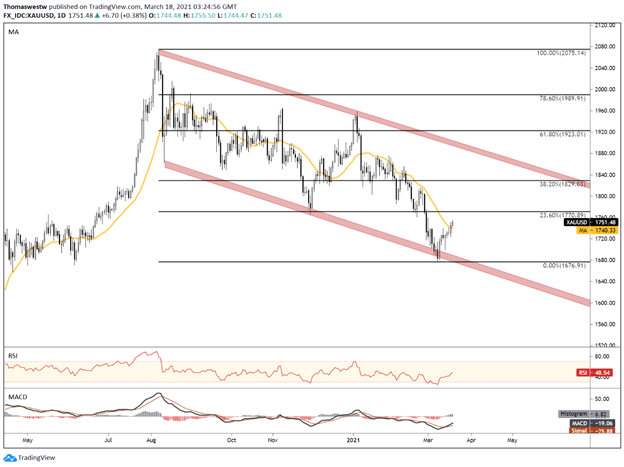

Gold’s technical posture has improved over the past week, with the yellow metal rebounding from the lower bound of a descending channel set from the August swing high. However, XAU/USD remains within the broader downtrend. To secure a solid bullish footing, it would need to pierce above the upper range of its channel.

The 20-day Simple Moving Average (SMA) was recaptured earlier this week, marking a short-term technical victory. Still, the 23.6% Fibonacci retracement level from the August – March move may pose as an area of resistance near the 1770 level. Momentum appears healthy, however, with both the MACD and Relative Strength Index (RSI) oscillators oriented higher.

Gold Daily Chart

Chart created with TradingView

XAU/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- What is your trading personality? Take our quiz to find out

- Join a free webinar and have your trading questions answered

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter