GOLD & CRUDE OIL TALKING POINTS:

- Gold prices unable to break range even as yields drop in risk-off trade

- Broadly resilient US Dollar might be capping scope for anti-fiat gains

- Crude oil prices continue to sink after telltale trend line support break

Gold prices surged as risk appetite withered across global financial markets. That pushed bond yields down alongside stocks, boosting the appeal of non-interest-bearing alternatives including the yellow metal. Sentiment-sensitive crude oil prices fell in line with the broader risk-off push.

The defensive mood emerged at the opening of European trade as traders there took their turn to respond to the latest trade war threat from US President Donald Trump. He poured cold water on hopes for a US-China détente after talks resumed at a G20 meeting in June, saying more tariffs could be imposed.

Soggy US economic data as well as a round of worrying earnings reports – notably from Netflix and freight operator CSX – extended the selloff into Wall Street trade. The catch-all MSCI World Stock Index suffered its largest daily drop in over a week.

GOLD MAY MISS OUT ON MARKET ROUT AS US DOLLAR ATTRACTS HAVEN FLOWS

Looking ahead, a relatively quiet economic data docket might keep sentiment trends in focus. Bellwether S&P 500 futures point convincingly lower, warning that de-risking may continue. That may bring deeper crude oil losses, but gold may struggle for upside follow-through if the US Dollar reclaims haven demand.

Indeed, a most pullback in the benchmark currency – a hardly surprising outcome against the backdrop of lower yields and a dovish shift in the priced-in Fed policy outlook – nevertheless kept it within a hair of recent highs. That speaks volumes about the appeal of its unrivaled liquidity at times of market turmoil.

Get the latest gold and crude oil forecasts to see what will drive prices in the third quarter!

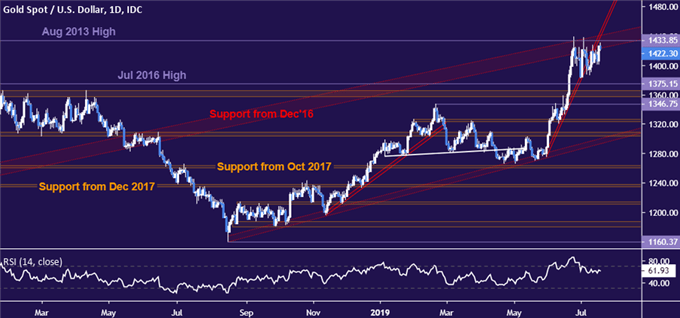

GOLD TECHNICAL ANALYSIS

Gold prices swung sharply higher but fell short of breaching resistance centered around the August 2013 high at 1433.85. A break higher sets the stage for a test above the $1500/oz figure. On the downside, sellers continue to face back-to-back support levels extending down through 1346.75.

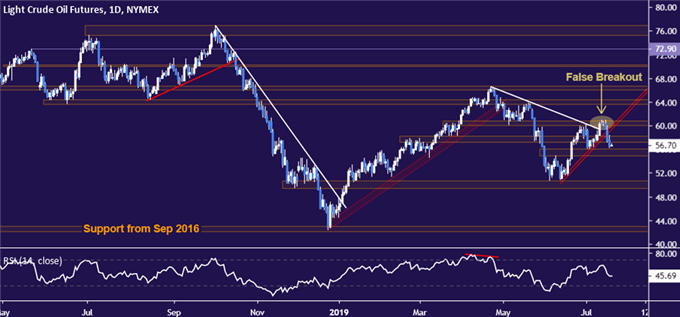

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices continue to decline after breaking support guiding the upswing from mid-June. A daily close below support at 54.84 exposes the 49.41-50.60 zone next. Alternatively, a rebound above resistance at 58.19 sets the stage for a retest of the 60.04-84 region.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter