CRUDE OIL & GOLD TALKING POINTS:

- Crude oil prices fall with stocks as Trump fuels trade war fears

- Gold prices swing lower on US retail sales data, USD strength

- EIA oil inventory flow data, Fed Beige Book survey due ahead

Crude oil prices tumbled alongside stocks as President Donald Trump forced the spotlight back to the US-China trade war, saying more tariffs could be imposed against the East Asian giant “if he wanted”. This warned that a longer-lasting spat might hurt global growth further, cooling energy demand.

Oversupply considerations probably figured into the selloff too. US Secretary of State Pompeo signaled that an opening for a diplomatic solution to tensions with Iran has emerged. Meanwhile, API data showed US stockpiles shed a mere 1.4 million barrels last week.

Official EIA inventory figures are next on tap, with analysts expecting an outflow of 3.7 million barrels. A downside surprise echoing the API report may give oil prices another downward nudge. How broader sentiment figures into the equation – boosting or countering selling pressure – is unclear for now.

GOLD AT RISK IF US DOLLAR REGAINS HAVEN BID, FED BEIGE BOOK EYED

Gold prices swung lower as US retail sales topped forecasts, narrowly trimming Fed rate cut bets and sending Treasury bond yields upward. Not surprisingly, this undermined the appeal of the non-interest-bearing metal. Receipts added 0.4 percent, topping forecasts calling for a 0.2 percent rise.

A resurgent US Dollar added to gold’s woes, sapping demand for anti-fiat alternatives. The benchmark currency scored its largest daily rise in two weeks. Weakness in European currencies appeared to account for much of the move, driven by Brexit-related jitters and soggy economic data.

Another batch of dovish comments from Fed Chair Powell failed to lift gold prices, as expected. This adds the sense that dovish policy bets have lost the ability to drive USD selling. That might allow haven demand to drive USD gains – punishing gold – if the incoming Fed Beige Book survey warns of sluggish growth.

Get the latest gold and crude oil forecasts to see what will drive prices in the third quarter!

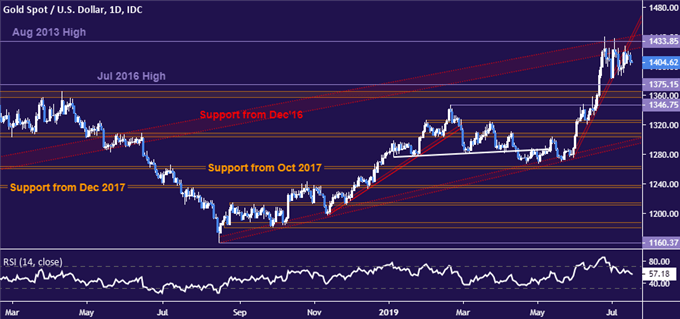

GOLD TECHNICAL ANALYSIS

Gold prices continue to mark time in an increasingly narrow range below resistance clustered around the August 2013 high at 1433.85. A break upward opens the door for a foray to test above the $1500/oz figure. Back-to-back support levels run down through 1346.75, with a push below that probably needed to neutralize the near-term bullish bias.

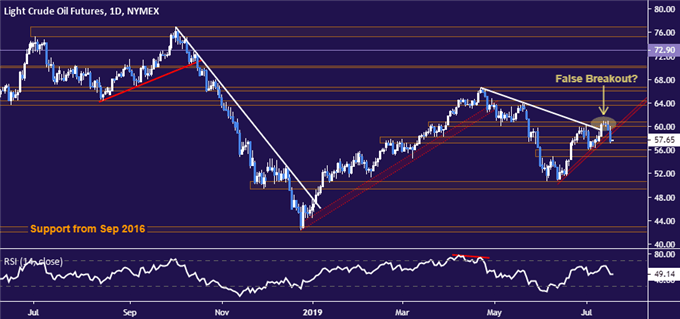

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices broke through support guiding them higher since mid-June, painting last week’s attempted uptrend resumption as a false breakout. The setup now suggests sellers have retaken the initiative, with a daily close below the support block running through 54.84 exposing the $50/bbl figure anew. Immediate resistance is in the 60.04-84 area.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter