GOLD & CRUDE OIL TALKING POINTS:

- Gold prices rise to 6-year high on dovish Fed, RBA, BOJ guidance

- Bank of England might be poised to join the pro-stimulus consensus

- Crude oil prices challenge range top the FOMC boosts risk appetite

Gold prices are surging in the hours following the FOMC monetary policy announcement, which markets took to be setting the stage for imminent easing. Priced-in expectations implied in Fed Funds futures reflect investors’ certainty that a rate cut is on the way next month. That has understandably weighed on bond yields and the US Dollar, boosting the relative appeal of non-interest-bearing and anti-fiat assets.

Cycle-sensitive crude oil prices were already on the upswing after EIA inventory data revealed a larger-than-expected drawdown when the FOMC statement hit the wires. Risk sentiment brightened at the prospect of policy support on the horizon, with the WTI benchmark accelerating higher alongside the bellwether S&P 500 stock index.

GOLD PRICES MAY EXTEND RISE ON DOVISH BOE, BUT FOR HOW LONG?

The US central bank joins the ECB in a nod toward stimulus. RBA Governor Philip Lowe struck a dovish tone as well, while the Bank of Japan reiterated its commitment to an already ultra-loose policy setting. The spotlight now turns to the Bank of England, which might offer a similarly defensive tone after a month of rapid deterioration in economic data outcomes (relative to baseline forecasts).

Gold may continue to power higher if Governor Mark Carney and company join the dovish chorus. Investors seem content to revel in the possibility for a coordinated downshift in global borrowing costs for the time being, overlooking its roots in slowing economic growth. The yellow metal may struggle to extend gains once they recall as much, triggering a bout of de-risking that is likely to fuel haven-seeking USD buying.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

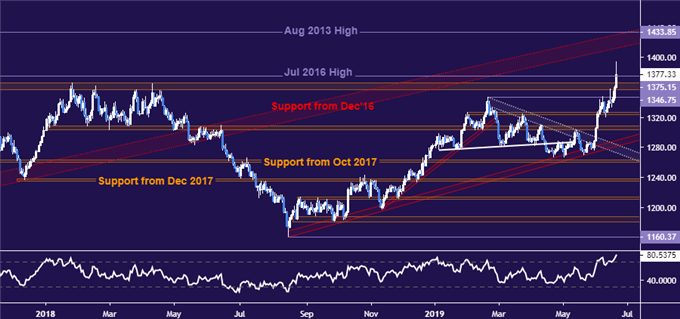

GOLD TECHNICAL ANALYSIS

Gold prices are pushing through long-standing resistance in the 1357.50-66.06 area to challenge the July 2016 high at 1375.15. Confirmation of a break on a daily closing basis sets the stage for a challenge of the August 2013 swing top at 1433.85. A move back below 1357.50 would see the next downside barrier at 1346.75.

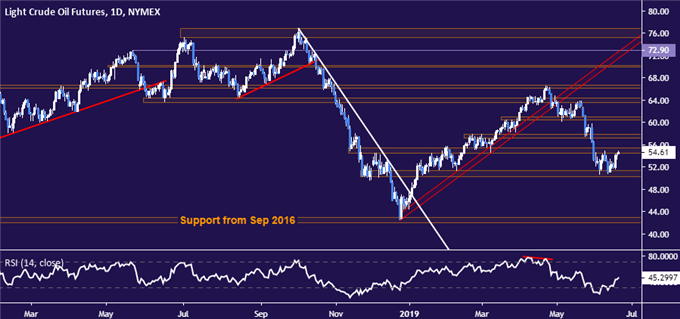

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices are pushing up against range resistance, with a daily close above its upper boundary at 55.37 opening the door for a test of the 57.24-88 area. Support is in the 50.31-51.33 zone. A turn below that would put the price floor set from September 2016 in the 42.05-43.00 region back into focus.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar and have your commodity market questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter