Fed Meeting Talking Points:

- Immediately following the announcement, the US Dollar sank while stocks and gold drove higher

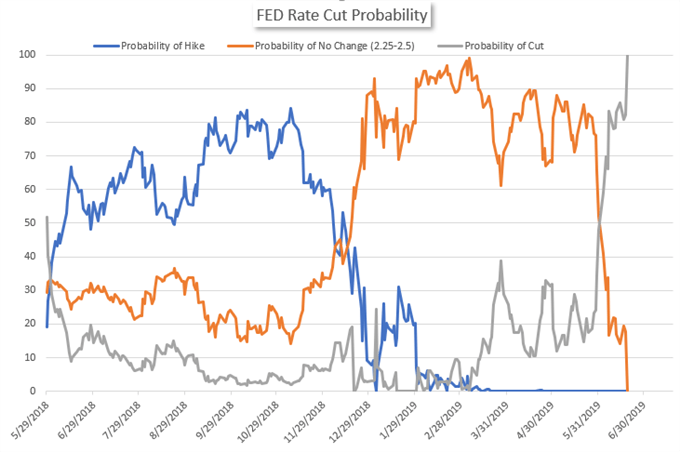

- The median forecast for the Fed Funds rate at the end of 2019 is no change, but markets are certain of a rate cut in July

- Chairman Powell said he “fully intends” to serve out his 4-year term as Federal Reserve Chairman despite criticism from President Trump

US Dollar Sinks After June Fed Meeting Signals Potential Rate Cuts

The US Dollar is lower after the Federal Reserve held the Federal Funds rate at 2.25% to 2.50%. While expected, the decision was not unanimous – with St. Louis Fed President Bullard voting for an immediate 25 basis point cut. The statement also contained a critical change in language in which reference to a “patient” policy path was removed.

In the subsequent press conference, Chairman Powell said that “in light of muted inflation pressures and increased uncertainties we now emphasize that the committee will closely monitor the implication of incoming information for the economic outlook and will act accordingly to sustain the expansion.” The remarks amount to a palpable shift in policy and opens the door to rate cuts in the near future. Consequently, the odds of a 25-basis point cut to the Fed Funds rate at July’s FOMC meeting have soared to 100%.

The Fed also included new language regarding inflation. In May’s FOMC meeting, officials found that inflation “remained low in recent months,” but shifted language in June to “market-based measures of inflation compensation have declined.” In the press conference, Chairman Powell stated that “rising wages are not providing an upward push on inflation.”

In October, Chairman Powell asserted inflation expectations are one of the larger drivers behind actual inflation – and said today that he found it notable that both inflation and inflation expectations have dropped. Taken together, the outlook for inflation further justifies a looser monetary policy regime.

Similarly, a change in language on economic growth was offered. At present, board members have shifted their outlook on the near-term economy downward, changing language regarding economic activity from “rose at a solid rate” in May to “rising at a moderate rate” in June.

Tangentially, Chairman Powell highlighted the importance of the ongoing trade wars on monetary policy as the theme has provided considerable uncertainty for economic growth and incoming data points. Apart from hard data, officials see trade wars as an important factor influencing market and economic sentiment – something the central bank has stressed in the past. Thus, the G-20 meeting late next week could shift the Fed’s stance once more if American and Chinese officials are able to reach a deal - or tangible progress at a minimum.

US Dollar Basket Price Chart (DXY): 1 - Minute Time Frame (June 19)

After immediately treading lower, the US Dollar fluctuated during Chairman Powell’s press conference. At the time of this article’s publication, the DXY Dollar Basket traded near 96.62 compared to the pre-FOMC price near 96.90.

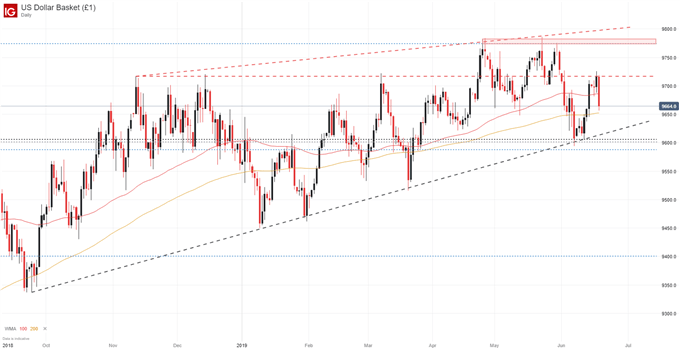

US Dollar Basket Price Chart (DXY): Daily Time Frame (October 2018 – June 2019)

Across a wider timeframe, the Dollar basket remains narrowly above the 200-day moving average at 96.50. With dovish intentions confirmed, the Dollar may experience pressure in the coming days – but will likely still find itself in a “best of the rest” position over the longer term as other central banks race to cut rates alongside the Fed.

Apart from the Dollar, US 2-year Treasury yields were sent to their lowest since early December 2017 – around 1.77. After recouping early-morning losses, the S&P 500 and Dow Jones were able to etch out minor gains, pressing to 2,926 and 26,528 respectively. Finally, gold surged to intraday highs around $1,356.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: USD Currency Volatility Highlighted by June Fed Meeting