GOLD & CRUDE OIL TALKING POINTS:

- Gold prices drop as USD reclaims support from haven demand

- Crude oil prices offset risk-off pressure with US supply worries

- Downbeat BOC rhetoric may trigger another bout of liquidation

Gold prices turned lower despite would-be support from falling bond yields as the US Dollar reclaimed its haven appeal following a lapse last week, trading broadly higher as stocks retreated. Crude oil prices idled, with pressure from the broadly risk-off environment apparently offset amid supply concerns as heavy rain and flooding forced offline several key US pipelines and refineries.

Looking ahead, a monetary policy announcement from the Bank of Canada is in focus. No changes in policy are expected but the accompanying commentary may shape global growth bets, particularly as recent data stokes worries about the spillover of global malaise into the heretofore resilient US economy. A downbeat tone may trigger another wave of risky asset liquidation.

Bellwether S&P 500 futures are pointing conspicuously lower in late Asia Pacific trade, bolstering the case for risk aversion. Cycle-sensitive crude oil looks vulnerable in this scenario, although incoming API inventory flow data may muddy the waters somewhat. A modest 633k-barrel drawdown is expected. Gold will continue to weigh divergent cues from bonds and USD in the meanwhile.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

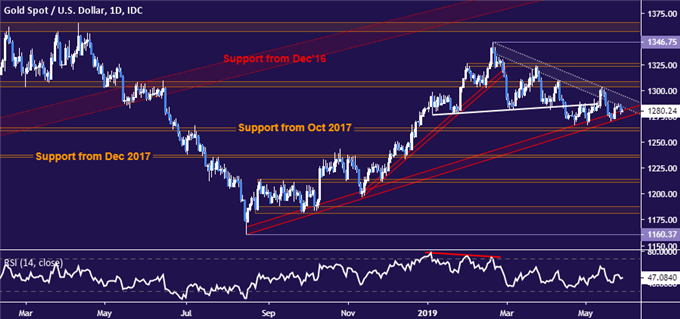

GOLD TECHNICAL ANALYSIS

Gold prices remain wedged between resistance set from late February (1295.10) and a rising trend line guiding the move higher since mid-August 2018 (1273.21). A break higher exposes the 1303.70-09.12 area, whereas a breach of support targets the 1260.80-63.76 zone.

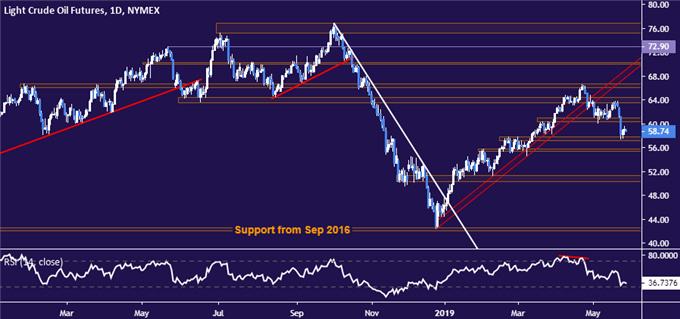

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices remain pinned to support in the 57.24-88 area. A daily close below it opens the door for a test of the 55.37-75 zone. Alternatively, a push above support-turned-resistance in the 60.39-95 region sets the stage for a challenge of the 63.59-64.43 price band.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter