GOLD & CRUDE OIL TALKING POINTS:

- Gold prices rise as yields drop in risk-off trade, US Dollar slips on PMI data

- Crude oil prices see largest daily drop yet in 2019 on growth, trade war fears

- Corrective risk recovery may struggle for momentum, US durables data due

Gold prices rushed higher as bond yields dropped amid deterioration in market-wide risk appetite, boosting the comparative appeal of non-interest-bearing alternatives. Haven-seeking demand for the US Dollar has constrained similar moves recently but the benchmark currency was unable to capitalize this time around as disappointing PMI data stoked Fed rate cut speculation.

Crude oil prices plunged, recording the largest one-day drop so far this year. The bellwether WTI contract fell alongside S&P 500 futures throughout the trading day, pointing to a dour turn in prevailing sentiment trends as the catalyst at work. That followed from swelling worries about the impact of a prolonged US-China trade war on global economic growth and – by extension – oil demand.

SOFT DURABLES DATA, US-CHINA TRADE WAR AND EU PARLIAMENT ELECTION FEARS MAY DERAIL MARKET RECOVERY

April’s US Durable Goods Orders data takes top billing on an otherwise quiet economic calendar through the end of the trading week. The markets’ violent reaction to yesterday’s soft PMI results may portend more of the same if this reading disappoints. As it happens, US data outcomes have tended to undershoot forecasts recently, warning about the elevated probability of just such an outcome.

Signs of weakness may sustain the risk-off drive into the weekly close, pushing oil lower still while gold extends upward. The miss will probably need to be substantial to overcome corrective flows as investors rebalance portfolios toward neutral ahead of a weekend prolonged by the Memorial Day holiday in the US. That is likely to degrade liquidity, amplifying already elevated kneejerk volatility risk.

Tellingly, futures tracking Wall Street equity benchmarks are pointing firmly higher in late Asia Pacific trade, reinforcing the sense that a retracement of yesterday’s moves is in the cards. Still, another batch of worrying headlines on the US-China trade war front, signs of eurosceptic triumph in on-going European Parliament elections, or an especially downbeat US durables report might revive liquidation.

Did we get it right with our crude oil and gold forecasts? Get them here to find out!

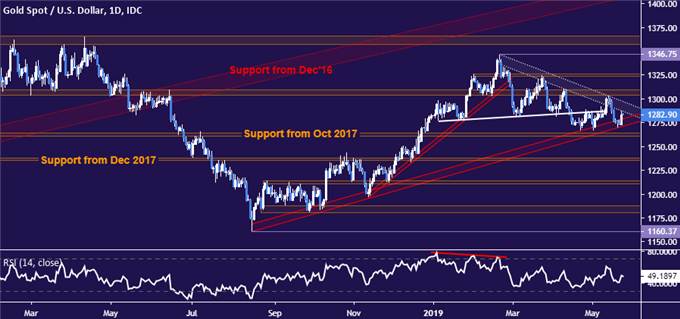

GOLD TECHNICAL ANALYSIS

Gold prices bounced at rising trend line support set from August 2018. Buyers now face resistance capping the upside since late February. A daily close above its outer layer – now at 1297.50 – exposes the 1303.70-09.12 area. This is followed by the 1323.40-26.30 zone. Alternatively, a move below the 1260.80-63.76 region would hit at bearish trend change and set the stage to test the 1235.11-38.00price band.

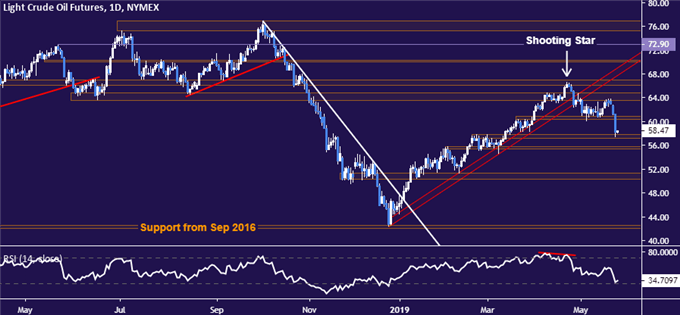

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices sank to support in the 57.24-88 area, setting a three-month low along the way. A daily close below this boundary targets the 55.37-75 zone next. Near-term resistance is in the 60.39-95 region, with a break above that eyeing a dense block of overlapping barriers starting at 63.59 and running to 67.03.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter