CRUDE OIL & GOLD TALKING POINTS:

- Crude oil price chart warns of a possible downturn ahead

- Gold prices still struggling to confirm topping chart pattern

- ECB meeting minutes, German factory orders now in focus

Commodity prices languished in familiar ranges Wednesday. Early optimism about progress in US-China trade talks did not find lasting follow-through (as expected). Negative cues from a dismal WTO outlook update and underwhelming services ISM data failed to capture the markets’ imagination either however.

Crude oil prices edged a bit lower as EIA inventory data revealed that stockpiles unexpectedly added 7.24 million barrels last week. Gold prices marked time, once again caught between competing influences from a fractionally lower US Dollar and gently higher Treasury bond yields.

CRUDE OIL MAY FALL ON ECB MEETING MINUTES, GERMAN FACTORY ORDERS

Looking ahead, minutes form the March ECB policy meeting as well as February’s German factory orders data headline the economic calendar. That the central bank was in a downbeat mood seems like foregone conclusion at this stage, but the extent of concern may still spook investors.

A negative turn in sentiment may be compounded if orders data from the world’s third-largest exporter undershoot expectations calling for a 0.3 percent increase. Global macro-economic news flow has broadly disappointed recently, highlighting the threat of just such an outcome.

If sentiment sours, cycle-sensitive crude oil prices are likely to decline alongside shares. The response from gold will probably depend on the extent to which such a move both weighs on yields and stokes haven demand for the Greenback.

See the latest gold and crude oil forecasts to learn what will drive prices in the second quarter!

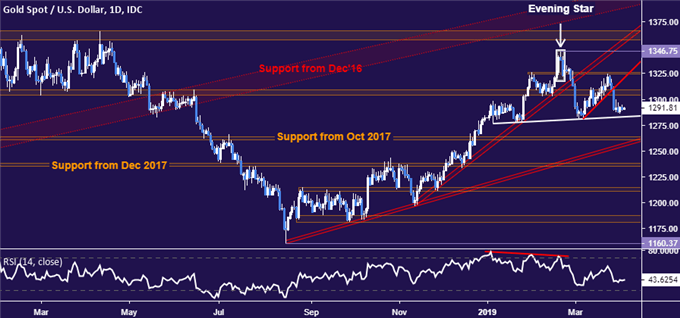

GOLD TECHNICAL ANALYSIS

Gold prices are still hovering above the neckline of a would-be Head and Shoulders topping pattern, struggling to build adequate momentum for a breakout. A daily close below this barrier – now at 1283.12 – would confirm the setup and initially expose the 1260.80-63.76 area. Alternatively, a turn back above the 1303.70-09.12 zone sets the stage to challenge 1326.30.

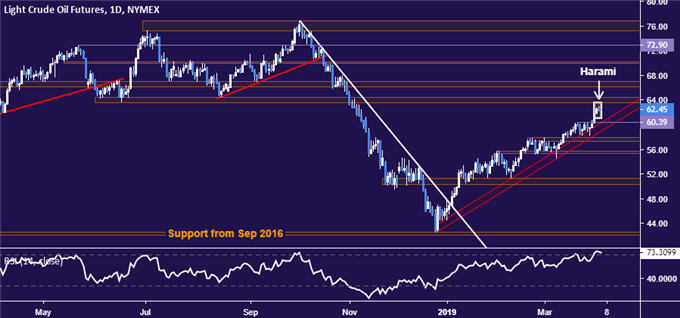

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices put in a Harami candlestick pattern below support-turned-resistance in the 63.59-64.43 area, hinting at indecision that may precede a reversal lower. Initial support at 60.39 but a sustained breakdown likely needs a break of trend support set from late December, now at 59.09. A push above 64.43 sees the next upside barrier in the 66.09-67.03 inflection zone.

COMMODITY TRADING RESOURCES

- Learn what other traders’ gold buy/sell decisions say about the price trend

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter