GOLD & CRUDE OIL TALKING POINTS:

- Commodities buoyed as Fed rates outlook cools after US jobs data release

- Gold prices attempt near-term trend break, crude oil prices pierce range top

- Fed officials’ hawkish tone may put commodity prices back on the defensive

Gold prices edged higher as the US Dollar retreated while the yield curve flattened after April’s US labor market data crossed the wires. It put the pace of wage of inflation at 2.6 percent on-year, undershooting consensus forecasts. This poured a bit of cold water on worries about an aggressive Fed tightening cycle on the horizon, boosting the relative appeal of non-interest-bearing and anti-fiat assets.

Crude oil prices likewise advanced, rising alongside the bellwether S&P 500 stock index as moderation in the Fed policy outlook translated into brightening risk appetite. The greenback’s backslide from intraday highs also helped. Oil is denominated in terms of the benchmark currency on global markets, so weakness there offered a degree of de-facto support.

FED COMMENTS MAY HURT COMMODITY PRICES

Looking ahead, a lull on the top-tier economic data front may put Fed-speak in the spotlight. Comments from Vice Chair Randal Quarles as well as four of the central bank’s regional branch presidents (Barkin, Bostic, Kaplan and Evans) are due to cross the wires.

Rhetoric building on the narrative in last week’s FOMC statement signaling an upshift in the expected pace of tightening beyond 2018 might offer the US Dollar another upward push at the expense of commodity prices. Immediate follow-through may be limited however, with traders reluctant to show directional commitment as weightier event risk looms ahead.

See our quarterly gold price forecast to learn what will drive the trend through mid-year!

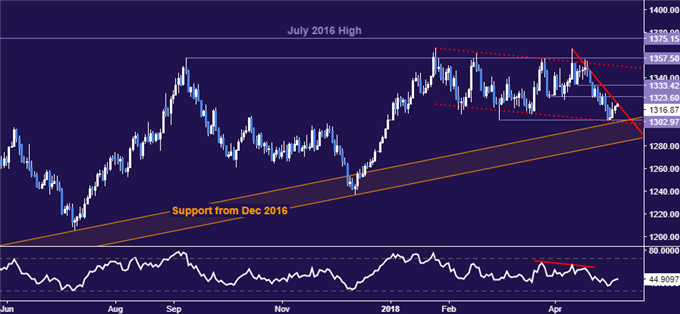

GOLD TECHNICAL ANALYSIS

Gold prices are testing the bounds of the near-term down move set from the April 11 high. A daily close above trend resistance at 1317.21 opens the door for a retest of former support at 1323.60. More importantly, it may precede a challenge of the broader down move in play since late January. Alternatively, breach below the support cluster in the 1301-03 area would bring a test of long-term trend support from December 2016.

CRUDE OIL TECHNICAL ANALYSIS

Crude oil prices breached resistance marked by the April 19 high at 69.53, opening the door for a challenge of the 38.2% Fibonacci expansion at 71.24. A further push beyond that targets the 50% level at 72.59. Alternatively, a move back below 69.53 – now recast as support – puts the range floor at 67.36 back in focus.

COMMODITY TRADING RESOURCES

- See our guide to learn about the long-term forces driving crude oil prices

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a Trading Q&A webinar to answer your commodity market questions

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

To receive Ilya's analysis directly via email, please SIGN UP HERE