Talking Points:

- Gold prices mark time as markets digest “Trump trade” volatility

- Crude oil prices weigh conflicting cues from API data, OPEC talks

- Trump cabinet appointments, EIA inventory data in the spotlight

Gold prices are marking time near the $1200/oz figure, left rudderless by a lull in top-tier news flow after two weeks of adjusting to a steepening Fed rate hike path projected in the aftermath of the US presidential election. The upcoming release of minutes from November’s FOMC meeting seems unlikely to shake things loose as investors look beyond December’s seemingly priced-in rate hike and toward the 2017 policy trajectory.

Fed officials have acknowledged that this is mainly a function of the looming fiscal policy pivot. That means the next significant bit of directional momentum may be triggered by the announcement of key appointments to the President-elect’s economic policy team. Investors are probably most eager to see who will be the next Treasury Secretary, although the naming of the new US Trade Representative and Commerce Secretary ought to be noteworthy as well.

Crude oil prices stalled as recent optimism about OPEC’s supply cut deal soured after officials from Iran and Iraq failed to find common ground yet again, deferring the conversation to the cartel’s formal meeting on November 30. A disappointed selloff may have been averted after API reported that crude inventories fell by 1.28 billion barrels last week. By contrast, official EIA stockpile figures due today are projected to show a build of 289.7k barrels. A print closer to the API estimate may reboot upward momentum.

See the schedule of upcoming webinars and join us LIVE to follow the financial markets!

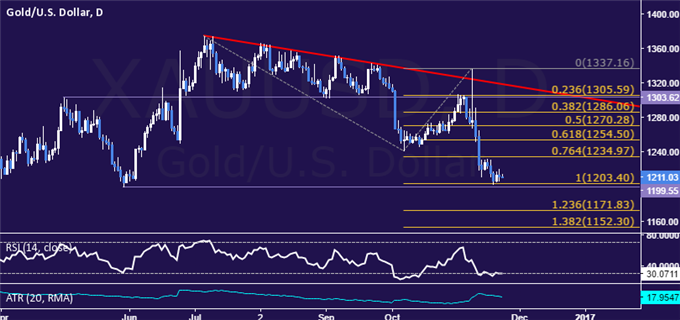

GOLD TECHNICAL ANALYSIS – Gold prices are in digestion mode after sinking to the lowest level in six months. A daily close below the May 30 low at 1199.55 exposes the 123.6% Fibonacci expansion at 1171.83. Alternatively, a reversal above the 76.4%level at 1234.97 targets the 61.8%Fibat 1254.50.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices stalled after touching the highest level in a month, failing to hold above resistance marked by the 50% Fibonacci expansion at 48.55. A daily close above this barrier targets the 61.8% level at 50.05. Alternatively, a turn back below the 38.2% Fib at 47.05 exposes resistance-turned-support at 45.92, the November 9 high.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak