Talking Points:

- Crude oil prices drop as expected after topping below $52/bbl

- Gold prices attempt to extend recovery for fourth straight day

- Risk-off mood may continue, gold may struggle before FOMC

Crude oil prices continued to fall alongside the S&P 500 as expected in the final hours of last week’s trade as risk aversion struck financial markets. More of the same was in store as Asian markets came online today amid pre-positioning for key upcoming event risk. The risk-off mood looks set to continue, with a quiet economic calendar offering no high-profile event risk to break momentum as European and US stock index futures point sharply lower in late overnight trade.

Gold prices have managed to find lasting support, rising against a backdrop of ebbing Fed rate hike bets. Year-end policy expectations implied in December 2016 Fed Funds futures continue to deteriorate, finishing last week at their most dovish in four months. The slump follows May’s deeply disappointing US jobs report. Upside momentum may wane in the days ahead however as traders turn leery of committing to firm directional bias ahead of the looming FOMC policy announcement.

Are gold and crude oil prices matching DailyFX analysts’ expectations? See our forecasts here !

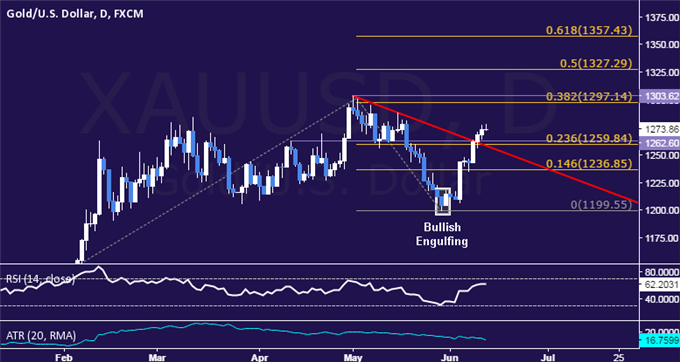

GOLD TECHNICAL ANALYSIS – Gold prices continue to press upward, with buyers working on a fourth consecutive daily gain to make for the longest winning streak in two months. Near-term resistance is in the 1297.14-1303.62 area (38.2% Fibonacci expansion, May 2). A daily close above that targets the 50% level at 1327.29. Alternatively, a reversal below the 23.6% Fib at 1259.84 sees the next downside barrier at 1236.85, the 14.6% expansion.

CRUDE OIL TECHNICAL ANALYSIS – Crude oil prices declined as expected after putting in a Bearish Engulfing candlestick pattern. Near-term support is in the 47.09-76 area (23.6% Fibonacci retracement, rising trend line), with a break below that on a daily closing basis exposing the 38.2% level at 45.37. Alternatively, a reversal above trend line support-turned-resistance at 50.10 opens the door for a retest of the June 9 high at 51.64.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak