New Zealand Dollar, RBNZ, Coronavirus – TALKING POINTS

- Stocks boosted by talks of another US stimulus, data suggested signs of stabilization

- New Zealand Dollar, Asia-Pacific markets focused on upcoming RBNZ rate decision

- NZD/JPY re-entered a congestive range but directionless interim may be short-lived

Wall Street trade ended the day on a happy note with the Dow Jones, S&P 500 and Nasdaq indices closing 0.50, 0.43 and 0.74 percent higher, respectively. The upbeat tune was amplified by US and European manufacturing, services and composite PMI figures coming in mostly better than expected. This helped lend credence to the notion that the world economy is beginning to show signs of economic stabilization.

Market buoyancy was also supported by comments from Treasury Secretary Steven Mnuchin who said the US might be out of a recession by year-end. He also said he has been speaking with lawmakers about another stimulus bill that could be passed as soon as July, with another round of stimulus checks being a possible measure. US home sales also grew more than expected, suggesting that consumer confidence is returning.

Foreign exchange markets were somewhat mixed, with the commodity-linked Swedish Krona and Norwegian Krone ending in the Green. The session’s biggest losers were the anti-risk US Dollar and petroleum-linked Canadian Dollar. Corporate credit markets showed signs of easing, particularly in Europe as signals of stabilization cooled fears of default and lower the premium for insuring sub-investment grade debt.

Wednesday’s Asia-Pacific Trading Session

The economic highlight of the session will be the Bank of New Zealand rate decision at 02:00 GMT, putting NZD in the spotlight. Renewed risk appetite has helped push the cycle-sensitive currency higher along with its cycle-sensitive peers, and modest signs of stabilization have buttressed hopes of economic stabilization. In terms of RBNZ policy, this may give the central bank a chance to relax and soften its rhetoric.

A comparatively less-dovish message could push the New Zealand Dollar higher if the urgency to introduce additional liquidity measures is alleviated. Monetary authorities have already deployed the Large Scale Asset Purchases (LSAP) programme which stipulates purchasing NZ$60 billion worth of government bonds. Hints at expanding this policy measure could hurt NZD.

NZD/JPY Analysis

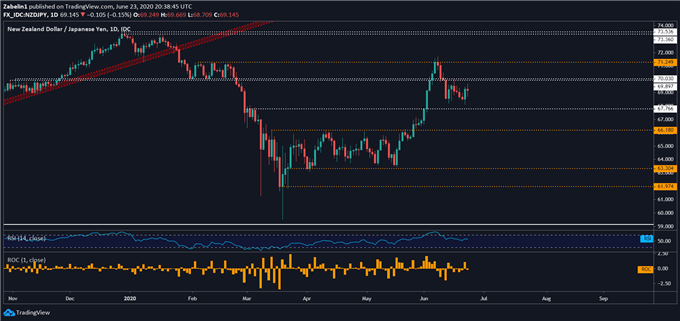

NZD/JPY has been stuck in a range between support at 67.766 and a two-tiered resistance range marked by the parameters 69.897 and 70.030. Its directionless nature since early-mid June comes after a clean rejection at a familiar stalling point at 71.249. Looking ahead, NZD/JPY may attempt to clear the two-layered ceiling again, though capitulation could inspire bears to come out of their caves.

NZD/JPY – Daily Chart

NZD/JPY chart created using TradingView

--- Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri Twitter