Australian Dollar, AUD/USD, US Dollar, Japanese Yen, Wall Street – Asia Pacific Market Open

- Australian Dollar fell with AUD/USD at risk to reversing its bounce

- Wall Street looked past less-pessimistic manufacturing activity data

- S&P 500 futures hint upbeat tilt as Fed eased capital requirements

Australian Dollar Drops Alongside Global Equities as US Dollar Gains

The sentiment-linked Australian Dollar was one of the worst-performing major currencies Wednesday as Wall Street traded in the red. The S&P 500 and Dow Jones closed -4.41% and -4.44% to the downside respectively, reflecting a pessimistic mood that prevailed throughout the Asia Pacific and European sessions. This followed a warning from US President Donald Trump who alluded to a “painful” two weeks amid the coronavirus.

Demand for safety and liquidity boosted the haven-linked US Dollar and similarly-behaving Japanese Yen. There was a cautious boost in sentiment after gauges of US manufacturing activity printed more optimistic than anticipated. Nevertheless, selling pressure resumed course into the close as the growth-linked Canadian Dollar followed lower alongside the New Zealand Dollar.

Thursday’s Asia Pacific Trading Session

S&P 500 futures are pointing higher heading into Thursday’s Asia Pacific trading session. The Federal Reserve announced that it will be temporarily excluding treasuries and deposits in leverage rules. This easing in capital requirements might have helped dim the sour mood in equities. This is as Trump could be looking into domestic travel limits for virus hot spots.

If the optimistic tone prevails, it could help to diminish anticipated losses in APAC equities such as the Nikkei 225 and ASX 200. That may trim recent losses that AUD/USD and NZD/USD experienced over the past 24 hours. This may also bode ill for the Japanese Yen. Follow-through is uncertain with global major benchmark stock indexes appearing to struggle with pushing through trend-defining resistance.

Australian Dollar Technical Analysis

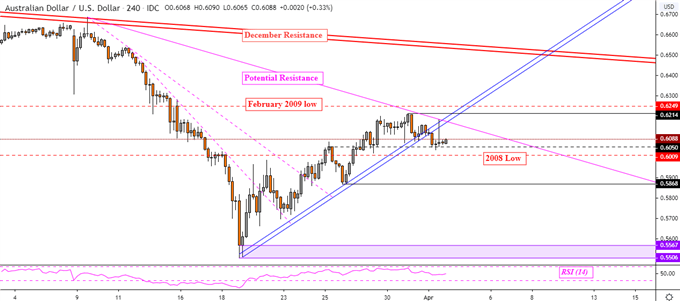

AUD/USD could be readying to reverse the bounce off lows from last month. This follows a break under key rising support on the 4-hour chart below – blue line. This is as “potential” resistance could guide the pair cautiously lower – pink line. A descent through 0.6050 exposes 0.5868. Otherwise a push above 0.6214 would resume the uptrend.

| Change in | Longs | Shorts | OI |

| Daily | 2% | 3% | 2% |

| Weekly | 29% | -46% | 0% |

AUD/USD 4-Hour Chart

Chart Created Using TradingView

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter