Asia Pacific Market Open Talking Points

- Australian Dollar rallied as Japanese Yen weakened on Monday

- Brexit optimism, US-China trade deal hopes fueled the S&P 500

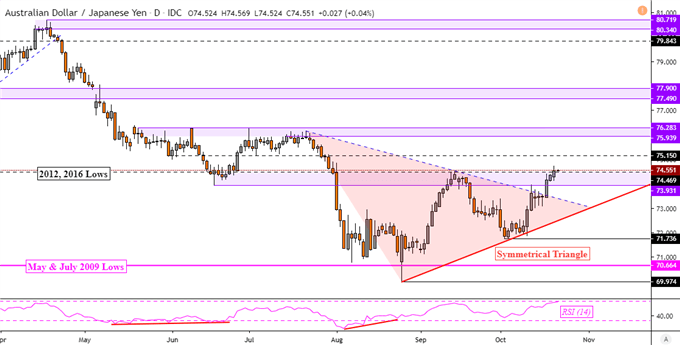

- AUD/JPY may extend gain, prices confirmed a pattern breakout

Find out what the #1 mistake that traders make is and how you can fix it!

AUD, NZD Rally Alongside Optimism in Stock Markets

The sentiment-linked Australian and New Zealand Dollars outperformed against their major counterparts on Monday. Their upward trajectories aligned with a pickup in risk appetite which saw the S&P 500 and US front-end government bond yields rally. This dynamic came at the expense of the anti-risk Japanese Yen and similarly-behaving Swiss Franc.

Over the past 24 hours, financial markets brushed aside news that UK Prime Minister Boris Johnson was dealt a blow after a definitive vote on his Brexit deal was delayed over the weekend. Then John Bercow – Speaker of the House of Commons – blocked a second meaningful vote on Johnson’s withdrawal agreement. He cited a convention going back to 1604 that aims to prevent casting ballots on the same motion twice.

This left the British Pound cautiously lower against its major counterparts, though markets still appear confident that a “no-deal” Brexit could be avoided. Later in the day, UK Cabinet Minister Jacob Rees-Mogg said that the government anticipates the Brexit bill to pass through the House by October 24. He added that Parliament will hold the first vote on the document around 18:00 GMT later today.

Meanwhile during the Wall Street trading session, stocks received support as US President Donald Trump said that he received a statement from China detailing that they expect a trade deal. Mr Trump hopes to sign one at next month’s APEC meeting in Chile, adding that a deal with his counterparts in Beijing is coming along “very well”. The MSCI Emerging Markets Index closed at its highest since July.

Check out our fourth quarter fundamental and technical outlook for the British Pound !

Tuesday’s Asia Pacific Trading Session

A relatively quiet economic docket during Tuesday’s Asia Pacific trading session places the focus for foreign exchange markets on risk trends. While Wall Street closed higher, S&P 500 futures are now little changed with a slight downside bias. This could pave the way for bittersweet optimism in regional bourses, though Japan markets will be offline for Imperial Enthronement Day. As such, we may see cautious gains in AUD.

Australian Dollar Technical Analysis

The AUD/JPY continues to make upside progress above the Symmetrical Triangle candlestick formation. Normally this pattern behaves as a continuation formation, but it can at times act as a reversal of the prior dominant trend. With prices above 74.47, this may pave the way for a test of near-term resistance at 75.15 before reaching the key psychological barrier between 75.94 – 76.28.

Chart of the Day – AUD/JPY

Chart Created Using TradingView

FX Trading Resources

- See how the Japanese Yen is viewed by the trading community at the DailyFX Sentiment Page

- See our free guide to learn what are the long-term forces driving the US Dollar

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter