Asia Pacific Market Open Talking Points

- US markets were offline for holiday, resulting in less liquid trading conditions

- Risk aversion on US-EU trade war fears boosted USD, trimming prior losses

- AUD/USD may decline on the RBA minutes after resistance kept prices at bay

Find out what retail traders’ equities buy and sell decisions say about the coming price trend!

The US Dollar had a mixed session on Monday as Wall Street closed for the Presidents Day holiday, resulting in less liquid trading conditions. Gains towards the latter half of the session helped trim previous losses that could have resulted in a much worse day for the Greenback.

This seemed to be triggered by a partial bout of risk aversion as Nikkei 225 futures sunk alongside the pro-risk Australian and New Zealand Dollars. A catalyst may have been threats from the European Union to retaliate against tariffs that the US may impose on the local automotive industry.

While European Commission President Jean-Claude Juncker noted that he believed US President Donald Trump would keep his word not to impose tariffs, Spokesman Margaritis Schinas struck a more defensive tone. Meanwhile, the regional bloc is preparing around $23b in retaliatory tariffs should the conditions warrant such a measure.

Looking ahead, Asia Pacific markets could have a more mixed start as S&P 500 futures are little changed. With RBA meeting minutes on the docket, the Australian Dollar could be vulnerable to losses if the details within the report underpin the central bank’s shift away from favoring a hike down the road.

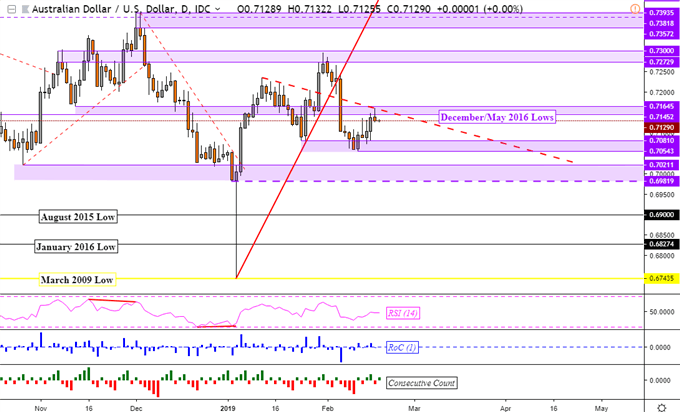

AUD/USD Technical Analysis

Declines in AUD/USD on Monday reinforced near-term resistance mentioned in this week’s technical outlook. This may set the stage for a decline to support which is a range between 0.7081 to 0.7054. A push above resistance exposes the highs achieved in January.

AUD/USD Daily Chart

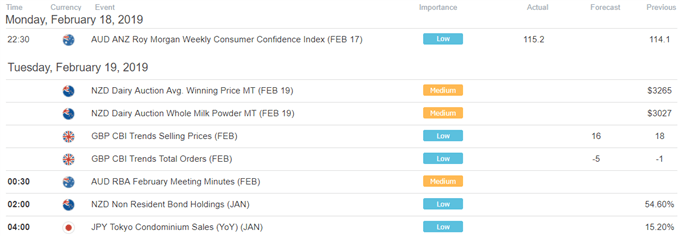

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter