Asia Pacific Market Open Talking Points

- Disappointing German industrial production soured sentiment as Euro fell

- Australian and New Zealand Dollars experienced their worst days in years

- USD eyes Jerome Powell speech after the best winning streak since October

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

Major Market Developments Wednesday

The rally on Wall Street paused after the S&P 500 halted its 5-day winning streak and closed lower 0.22%. Pessimism in investors started building up earlier in the day on disappointing German economic data. Factory orders contracted 7.0% y/y in December versus 6.7% expected, the largest decline since June 2012. The Euro declined given that the ECB is facing another obstacle, the largest EU economy slowing.

The pro-risk Australian and New Zealand Dollars had one of their worst days since 2016 and 2017 respectively. Their moves had more to do with monetary policy fundamentals though. AUD/USD tumbled as RBA’s Governor Philip Lowe shifted away from favoring a hike as their next move, underscoring increasing dovish policy bets. NZD/USD declined on a worse-than-expected domestic jobs report.

Asia Pacific Trading Session

We begin Thursday’s Asia Pacific trading session with a speech from Fed Chair Jerome Powell. This will be his first one since last week’s dovish central bank rate announcement. The US Dollar has been on a tear, climbing for 5 consecutive days which is its best winning streak since October 2018.

A cautious tone from Mr. Powell that echoes last week’s cautiousness may put those gains on hold and vice versa. S&P 500 futures are pointing lower, hinting that APAC equities could be in for declines next. That would continue adding gains to the anti-risk Japanese Yen from the past couple of days.

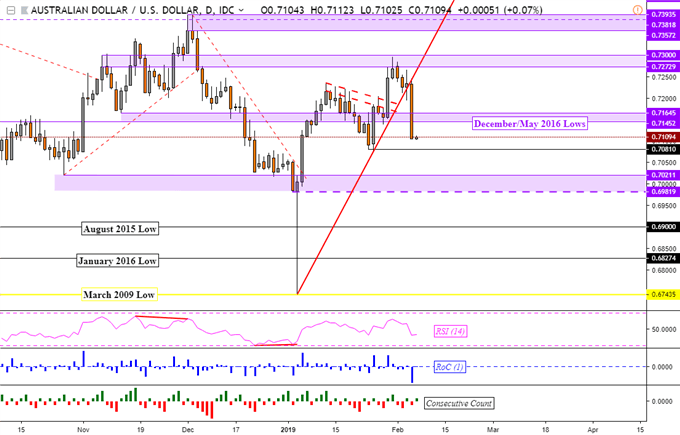

Australian Dollar Technical Analysis

The 1.78% decline in AUD/USD resulted in the pair descending through a rising support line from the beginning of this year. On top of that, a horizontal range of support (0.7145 – 0.7164) was also breached. With confirmation, this could lead to further weakness down the road. A push through 0.7081 might be that signal.

I will be beginning this week’s poll to determine which Aussie crosses to cover in this week’s technical forecast. If you would like to participate, follow me on twitter @ddubrovskyFX. I will post timely updates on the Aussie Dollar there as well.

AUD/USD Daily Chart

Chart created in TradingView

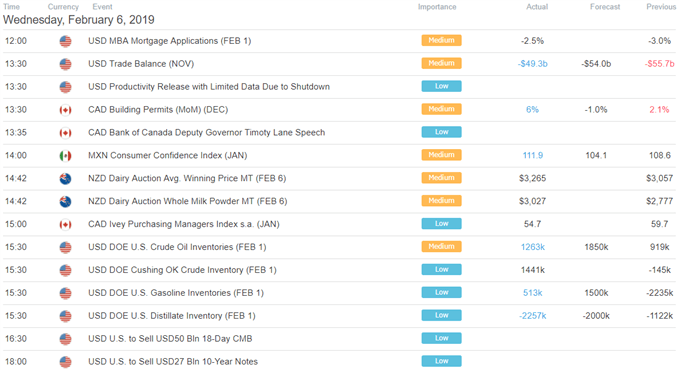

US Trading Session Economic Events

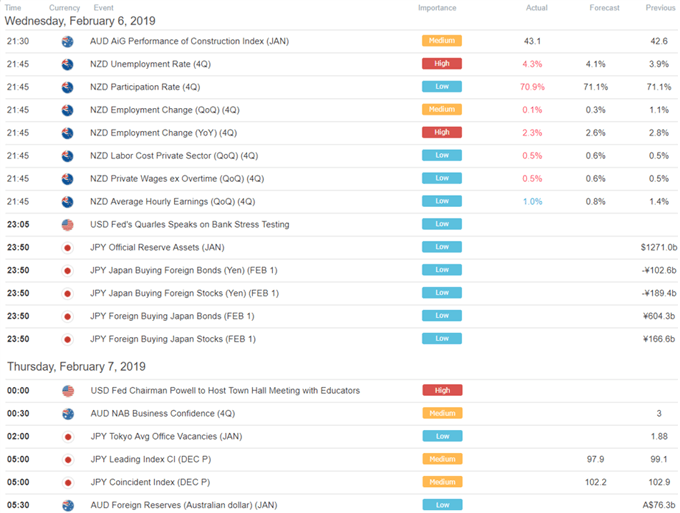

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter