Asia Pacific Market Open Talking Points

- British Pound recovered after BoE as Mark Carney left rate hike on the table

- Sentiment sours across financial markets, latest trade war news disappoints

- APAC equities may fall, leaving AUD/USD at risk as Japanese Yen ascends

Trade all the major global economic data live and interactive at the DailyFX Webinars. We’d love to have you along.

3 Things to Know Before Trading APAC Markets

1 – GBP Recovery Despite Downgrade in BoE Economic Projections

Initially, the British Pound fell on the ‘Super Thursday’ Bank of England rate decision. The central bank downgraded various economic projections, expecting the weakest pace of growth in 2019 since 2009. These estimates were also based on a smooth Brexit. Meanwhile, UK Prime Minister Theresa May headed to Brussels and as has been the norm, failed to achieve significant progress with her EU counterparts on a deal.

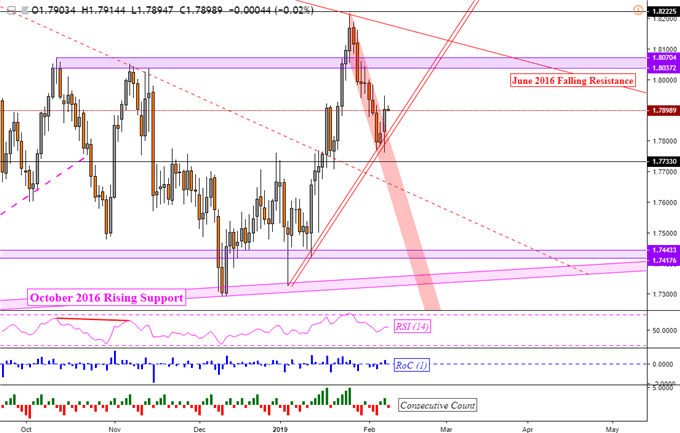

But, Sterling managed a breakthrough rally thanks to supportive commentary from BoE Governor Mark Carney. He mentioned that the markets should not leave prospects of a rate hike off the table. Looking at an equally weighted British Pound index below (versus EUR, JPY, CAD and USD), the recovery in GBP has pushed it closer towards forming a Head and Shoulders pattern which is typically a bearish signal.

Equally Weighted British Pound Index

Chart Created in TradingView

2 – Trump and Xi Meeting Before Tariff Deadline Not Happening?

The unexpectedly hawkish tone from Mark Carney and gloomy domestic economic projections combined with a lack in progress towards a smooth Brexit unsurprisingly boded ill for equities as expected. Towards the end of the session, news crossed the wires from US President Donald Trump that it is unlikely he will be meeting with China’s President Xi Jinping before the March 1 deadline when tariffs are back on the table.

The S&P 500 dropped almost one percent and the Euro Stoxx 50 closed roughly two percent lower. The anti-risk Japanese Yen gained against its major counterparts with the pro-risk New Zealand Dollar aiming lower. The US Dollar traded mixed with cautious gains here and there. Gains in Sterling likely sapped some of the Greenback’s upside potential when stocks collapse.

3 – Friday’s Asia Pacific Trading Session

As we head into the end of the week, S&P 500 futures are pointing lower hinting that the pessimistic mood in markets may continue. As such, Asia Pacific benchmark stock indexes may trade lower. The Nikkei 225 is already showing signs of weakness. This would bode ill for the Australian Dollar which is also eyeing the RBA Statement on Monetary Policy.

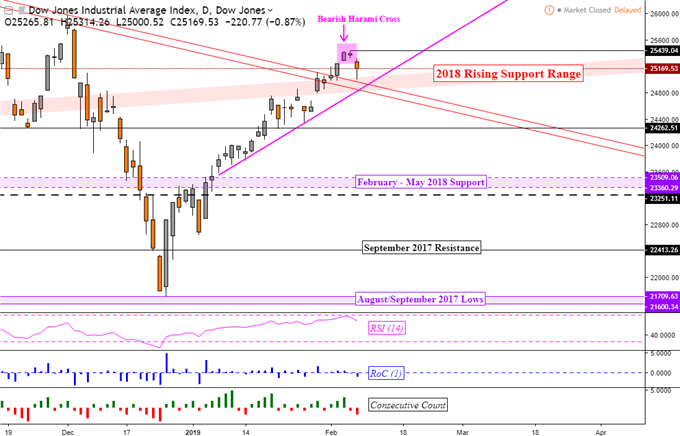

Dow Jones Technical Analysis

The Dow Jones Industrial Average has formed a Bearish Harami Cross candlestick pattern at its recent top. This was followed with a close lower. A descent through the rising trend line from earlier this year may open the door to more losses ahead. For more timely updates, you may follow me on twitter @ddubrovskyFX for the latest market moves.

Dow Jones Daily Chart

Chart created In TradingView

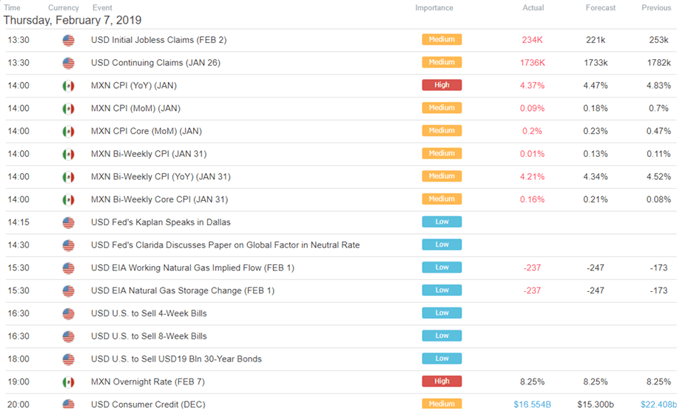

US Trading Session Economic Events

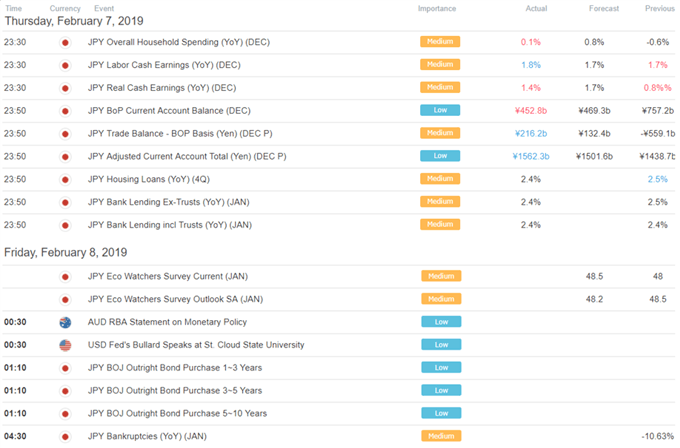

Asia Pacific Trading Session Economic Events

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter