Asia Pacific Market Open – Swiss Franc, Jerome Powell, Fed, S&P 500, AUD/USD

- Swiss Franc was worst performing major, undermined by dovish ECB minutes & stocks rising

- Fed Chair Jerome Powell lifted S&P 500 after lack of clear outcome on US China trade talks

- Asia Pacific markets may follow US stocks higher. AUD/USD, ASX 200 add to bullish reversal

We recently released our Q1 forecasts for currencies like the US Dollar in the DailyFX Trading Guides page

The anti-risk Swiss Franc was overwhelmingly the worst performing major on Thursday, weakening thanks to the improvement in market mood and dovish ECB meeting minutes. German government bond yields declined as the Euro Stoxx 50 rose. Typically, bond yields and stocks rise in tandem. But, looser monetary policy can sometimes flip that relationship.

Hence CHF got a nice double boost unlike the Japanese Yen, which did not have the luxury of dovish BoJ updates as it traded rather mixed. The ‘risk on’ trading dynamic seen during the US trading session led the S&P 500 towards its 5th consecutive day of gains. This is the best winning streak since September 2018. Achieving 6 would mean the most impressive streak in about 11 months.

After Asia stocks were somewhat disappointed by a lack of clear cut US China trade talk news, FedChairJerome Powell added some fuel to the rally in stocks later in the day. Mr. Powell talked down some economic pessimism priced in the markets, saying that the labor market is very strong by so many measures. He added that the central bank is waiting, watching and that it can be patient and flexible.

This adds to the point that the central bank is quite data dependent which is a more uncertain path and it does not necessarily mean that there will not be hikes this year. The US Dollar traded little higher as it rose with rising government bond yields. Meanwhile the Canadian Dollar also gained as crude oil prices entered its 8th day of gains.

Additional Commentary from Fed Chair Jerome Powell:

- Fed has the ability to be patient on rates

- There is no pre-set path for rates

- Longer shutdown will show up clearly in economic data

- Watching China’s economy which has slowed and is a concern

- If trade dispute leads to lower tariffs it is good

With that in mind, Asia Pacific benchmark stock indexes may resume rising as the ASX 200 edges closer to completing a bullish reversal pattern. Prolonged optimism in the markets may continue pushing AUD/USD prices higher as anticipated in my weekly technical forecast. I am conducting a poll on twitter to determine which Aussie crosses to cover next week for my technical forecast. Follow me on twitter @ddubrovskyFX to cast your votes!

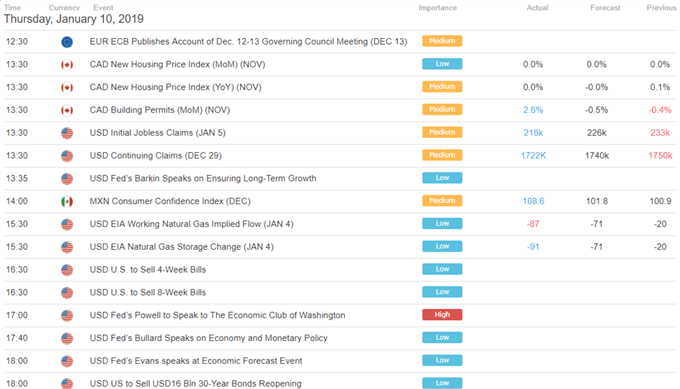

US Trading Session

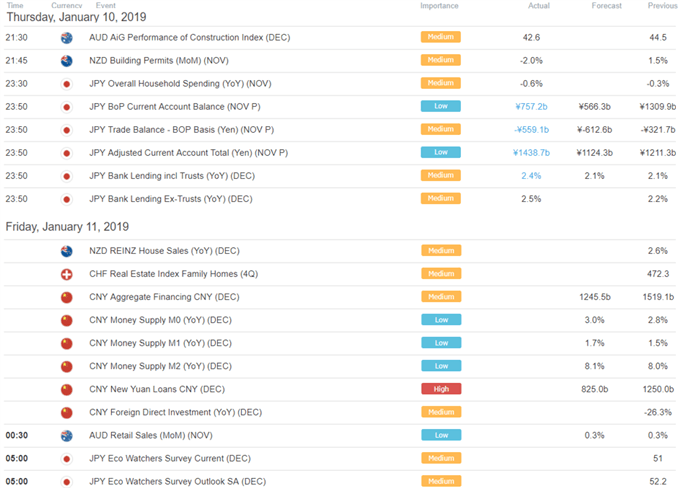

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter