Asia Pacific Market Open – Brexit, Theresa May, British Pound, S&P 500, US Shutdown, NZD

- British Pound declines on Theresa May winning no confidence vote as markets eye Brussel talks

- S&P 500 gave up most of its gains amidst US government shutdown concerns, US Dollar lower

- NZD fell on lower GDP estimates. Asia stocks may gain, focusing on trade war relief expectations

Just getting started trading the New Zealand Dollar? See our beginners’ guide for FX traders to learn how you can apply this in your strategy!

UK Prime Minister Theresa May survived the vote of no confidence Wednesday, securing her leadership through the Brexit negotiations and reducing uncertainty. So why then did the British Pound simultaneously drop about 0.5%? Keep in mind, markets are forward looking. In fact heading into the vote, Sterling rallied up a storm as members of parliament casted their support for the Prime Minister.

Once her leadership was confirmed, markets are now facing reality. Theresa May is heading off to Brussels in an attempt to gather more concessions from the EU to build support for her unpopular Brexit draft. This seems unlikely as one of the main points of her draft is to restrict free movement of people, which entails leaving the single market. The odds are against her and GBP/USD headed lower.

Still, Sterling was the best performing major amidst a general improvement in risk appetite. Stocks rallied in Asia, Europe and on Wall Street. This followed improving US China trade talks where the latter nation agreed to cut auto import tariffs from the former. The Huawei situation also improved as the Nikkei 225 rose 2.15%, the DAX climbed 1.38% and the S&P 500 gained 0.54%.

However, the S&P 500 did trim most if its upside progress on more US government shutdown concerns. President Donald Trump wants $5b to build a wall on the US-Mexico border, threatening a shutdown if funding is not secured. Today he cited the French protests as leverage to strength US borders, increasing concerns of a showdown between him and his Democratic counterparts.

The US Dollar aimed lower against its major counterparts as demand for the highly liquid and reserve currency waned, particularly during the first half of the trading session. During the same timeframe, the pro-risk New Zealand Dollar surprisingly succumbed to selling pressure. A clear catalyst seemed absent however.

Speaking of NZD, as Thursday’s Asia Pacific trading session began, more disappointing global growth outlooks crossed the wires. New Zealand’s Treasury envisioned 2018-19 annual GDP expansion at 2.9% versus 3.8% previously estimated. NZD/USD sank about 0.2%. Excluding US fiscal concerns, Asia Pacific benchmark stock indexes may trade higher, continuing to capitalize on ebbing trade war fears. This may bode ill for the anti-risk Japanese Yen.

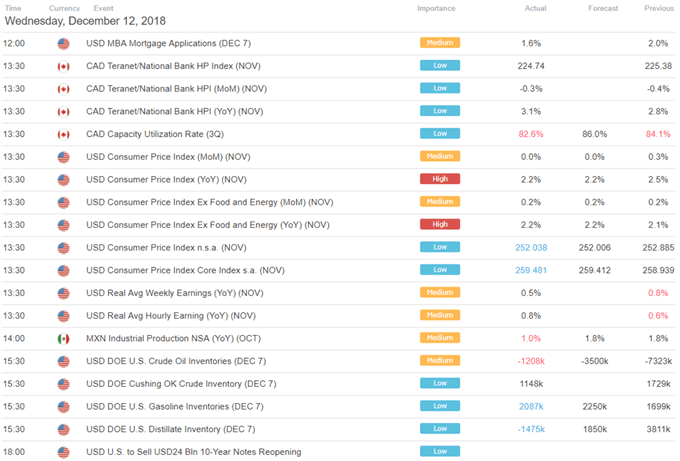

US Trading Session

Asia Pacific Trading Session

** All times listed in GMT. See the full economic calendar here

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Join a free Q&A webinar and have your trading questions answered

- See our free guide to learn what are the long-term forces driving US Dollar prices

- See our study on the history of trade wars to learn how it might influence financial markets!

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter