CAD/JPY Talking Points:

- This is part of the DailyFX Q3 Top Trades.

- See the favorite trades from each DailyFX Analyst for the third quarter. Download our new 3Q top trading opportunities guide from the DailyFX Free Trading Guides.

Yen weakness returned in Q2 as the risk-on trade ran with a full head of steam. US equities notched fresh all-time-highs and US Dollar bears made their mark in the first two months of the quarter, with a notable pullback showing in June around the FOMC rate decision.

But, it was at that same rate decision that kickstarted a round of US Dollar strength that FOMC Chair, Jerome Powell, said that market participants should take the dot plot matrix and the Fed’s forecasts with a grain of salt. That’s what helped to really propel stocks, and risk assets, as it became clear once again that the world’s largest national central bank is backstopping markets and apparently happy to continue doing so.

This does create some interesting dynamics elsewhere, however, such as around the Japanese Yen and the Canadian Dollar.

The Bank of Canada created some surprise in April when they became one of the first globalized central banks to start talking about post-pandemic policy. This led to a strong run of Canadian Dollar strength that was similarly supported by rising oil prices. The Bank of Japan, however, continues to hold negative rates as they have since 2016. And there appears to be little sign of anything changing on that front, even as a potential shift appears ahead of or around the Federal Reserve.

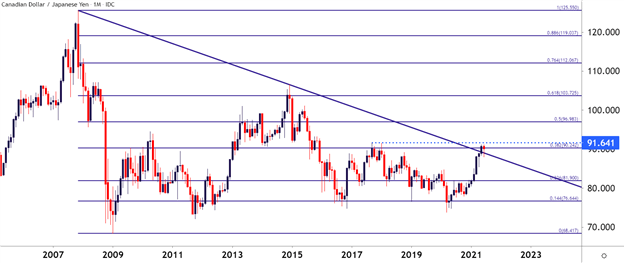

This has supported a strong trend in CAD/JPY that’s propelled the pair up to fresh three-year-highs. And very nearby is an important watermark, plotted at 91.64 which is the current five-year high in the pair.

CAD/JPY Monthly Price Chart

Chart prepared by James Stanley; CADJPY on Tradingview

CAD/JPY Bullish Breakout Potential

A big technical item took place in CAD/JPY during the month of May when price action broke above a descending trendline that’s connecting 2018 and 2014 swing highs. This also came along with a test above the psychological 90 level.

This keeps the door open for bullish breakout potential ahead of the Q3 open, and this can be followed by first looking for a test of the five-year-high plotted at 91.64, after which another interesting spot opens on the chart around 93.25. If buyers can push through here, then the 95.00 psychological level would be the next big spot to follow.

CAD/JPY Weekly Price Chart

Chart prepared by James Stanley; CADJPY on Tradingview

--- Written by James Stanley, Senior Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX