US Dollar, Singapore Dollar, New Taiwan Dollar, Thai Baht, Philippine Peso, ASEAN, Fundamental Analysis – Talking Points

- US Dollar gains versus ASEAN currencies despite rally in Emerging Market stocks

- Rising longer-dated Treasury yields cushioning Greenback on fiscal stimulus bets

- APAC, ASEAN data: China & Indonesian trade, India industrial output and CPI

US Dollar ASEAN Weekly Recap

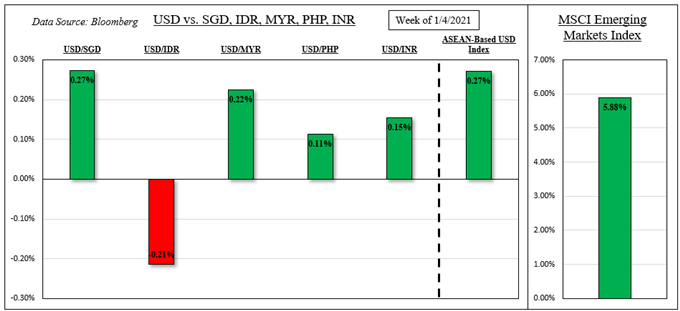

The haven-linked US Dollar received a break from its persistent losses to start off 2021, gaining ground against ASEAN currencies such as the Singapore Dollar, Malaysian Ringgit and Thai Baht. This is despite broad strength in developing nation equities, with the MSCI Emerging Markets Index (EEM) rallying 5.9%. That was the best performance over the course of a week in 2 months.

A couple of notable standouts were the New Taiwan Dollar and Indonesian Rupiah. The former gained as Taiwan’s benchmark stock index rallied almost 5% over the course of 5 days. The semiconductor-heavy index capitalized on gains in tech shares as TSM reported sales rising 13.6% y/y in December. USD/IDR fell as investors priced in faster economic recovery expectations.

Last Week’s US Dollar Performance

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

External Event Risk – Treasury Yields, Fiscal Stimulus, US Retail Sales and Sentiment

The anti-risk US Dollar, with local lending rates so low, typically tends to weaken when stocks outperform, so what gives? As a result of Democrats taking both seats in the Georgia Senate runoffs, that has raised fiscal stimulus prospects in the world’s largest economy. That has in turn raised the outlook for growth and recovery, pushing longer-dated Treasury yields to their highest since early 2020.

Raising rates of return from the US are likely benefiting the Greenback’s appeal, especially as yields from there outpaced those from ASEAN nations this past week. Pairs like USD/SGD and USD/THB saw their steady descents slow. Going forward, expectations of government stimulus could continue pushing Treasury yields higher, offering the US Dollar a break from persistent losses.

Check out my latest ASEAN technical report for USD/SGD, USD/TWD, USD/THB and USD/IDR levels!

Last week’s dismal non-farm payrolls report underpinned the need for more support, as President-elect Joe Biden stated. Still, as the FOMC minutes revealed, the central bank sees the current pace of bond purchases as appropriate. Lose policy is likely here to stay for the time being, and it is unclear just how far Treasury rates can run.

Risks that could offer some fuel to the US Dollar include rising cases of the coronavirus, especially a new more-contagious strain. Lockdown threats may pose a threat for equities, pushing the Greenback higher. All eyes are also on US retail sales and University of Michigan Sentiment on Friday. These will continue to reveal the state of health in the consumption-driven nation.

ASEAN, South Asia Event Risk – Chinese and Indonesian Trade, India Industrial Production

The ASEAN economic docket is fairly light, with USD/IDR eyeing Indonesian trade data on Friday. In South Asia, USD/INR is eyeing Indian industrial production and CPI on Tuesday. The latter is expected to slow further, opening the door to RBI rate cut bets and perhaps a turning points for the Indian Rupee. China, a key trading partner for ASEAN countries, release its trade balance on Thursday.

Check out the DailyFX Economic Calendar for ASEAN and global data updates!

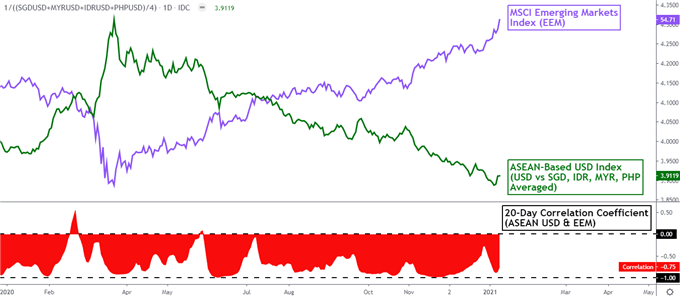

On January 8th, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and the MSCI Emerging Markets Index fell to -0.75 from -0.63 one week ago. Values closer to -1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-Based USD Index Versus MSCI Emerging Markets Index – Daily Chart

Chart Created Using TradingView

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

-- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter