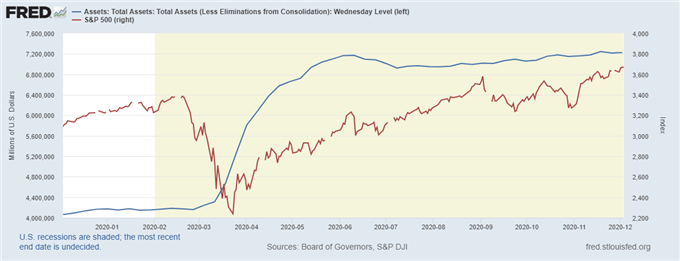

2020 proved once again that you should always follow two of the commandments laid out by Wall Street legend Marty Zweig in his 1986 book titled “Winning on Wall Street”: don’t fight the tape and definitely don’t attempt to fight the Fed. With markets in free-fall during the coronavirus crash in March, the Federal Reserve valiantly stepped in to stop the bleeding. The central bank rapidly cut interest rates, introduced a slew of lending facilities and implemented an open-ended Quantitative Easing program to stabilize financial conditions.

This sent equity markets soaring, with all three US benchmark indices surging to set fresh record highs this year. However, the remarkable rise in asset prices hardly makes sense when you consider that US GDP registered a record contraction of 31.4% in the second quarter of 2020 and the unemployment rate surged to a high of 14.7%.

Nevertheless, market participants continued to pile into risk assets, dismissing the notable deterioration in economic fundamentals in favour of the liquidity-rich backdrop provided by the Fed. As Zweig says, “the monetary climate – primarily the trend in interest rates and Federal Reserve policy – is the dominant factor in determining the stock market’s major direction”. Clearly, this adage continues to hold weight and should serve as a cornerstone for investors when positioning their portfolios.

Federal Reserve Balance Sheet – Total Assets vs. S&P 500 Index

-- Written by Daniel Moss, Analyst for DailyFX

Follow me on Twitter @DanielGMoss