US Dollar, Singapore Dollar, Indonesian Rupiah, Philippine Peso, Malaysian Ringgit – Talking Points

- US Dollar extended gains against ASEAN currencies on rising volatility

- All eyes turn to the Federal Reserve, US sentiment and retail sales data

- USD/IDR may fall on Bank of Indonesia, Chinese industrial output eyed

US Dollar ASEAN Weekly Recap

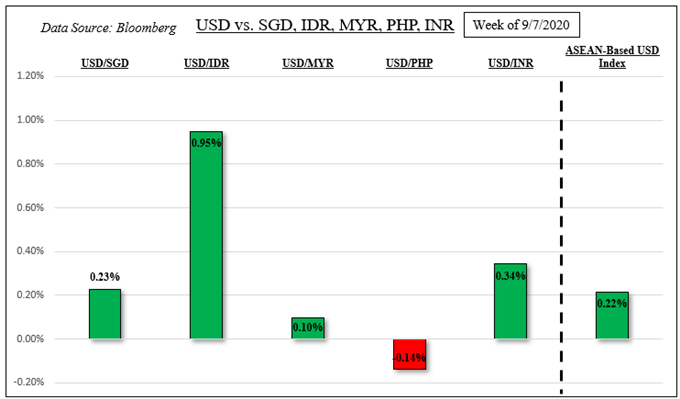

The haven-linked US Dollar cautiously rose against its ASEAN counterparts such as the Singapore Dollar, Indonesian Rupiah and Malaysian Ringgit. Gains occurred in tandem with rising volatility in financial markets as equities on Wall Street traded in the red for a second consecutive week. This may have been triggered by a combination of rising US-China tensions and concerns about loft valuations in tech shares. The former was in the minds of investors as President Donald Trump touted a ‘decoupling’ from China.

The Indonesian Rupiah was a standout, weakening almost 1 percent over the past 5 trading days. Jakarta’s Governor, Anies Baswedan, declared a state of emergency in the capital city due to rising cases of the coronavirus. The local benchmark stock index, the Jakarta Composite, slumped 4.26% last week as net foreign stock investment slumped US$150 million on Friday, the most since January 2019. The Philippine Peso rose as the nation saw positive net foreign stocks investment for the first time in over 2 weeks on Thursday.

Discover your trading personality to help find optimal forms of analyzing financial markets

Last Week’s US Dollar Performance

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

External Event Risk – Federal Reserve, University of Michigan Sentiment, US Retail Sales

Given how sensitive emerging market currencies can sometimes be to the direction of capital flows, the focus for ASEAN FX will likely remain on external factors – see chart below. USD/SGD, USD/IDR, USD/MYR and USD/PHP will be closely eyeing Wednesday’s Federal Reserve interest rate announcement. No changes to benchmark lending rates are expected, with investors likely eyeing the central bank’s forward guidance.

Lately, the Fed’s balance sheet has remained more or less unchanged. This could be another factor pushing equity valuations lower, a thirst for more liquidity, opening the door to further disappointment this week. That could weaken ASEAN FX. Another downside risk is the cooldown in rosy US economic data surprises. The Citi Economic Surprise Index tracking the US continues to fall from highs set in June.

This could open the door to lackluster University of Michigan Consumer Confidence data on Friday, which continues to diverge with the rise in stocks since late March. Retail sales on Wednesday may also meet a similar fate. These economic data speak to the largest segment of US GDP, consumption. A slowdown on this front could derail swift recovery expectations, boosting market volatility.

ASEAN, South Asia Event Risk – Bank of Indonesia, Chinese Retail Sales and Industrial Production

USD/IDR may fall on the Bank of Indonesia monetary policy announcement. No changes to the 7-day reverse repo rate are expected, but Governor Perry Warjiyo could reiterate the central bank’s strategy to uphold IDR via intervention. This could reverse some of the recent weakness seen in the Rupiah.

ASEAN FX may also pay close attention to Chinese retail sales and industrial production data on Tuesday. These will reveal further insight into the recovery within the world’s second-largest economy. For ASEAN nations, China is a key trading partner. Economic performance there can domino outward to its neighbors.

On September 11th, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and my Wall Street index was -0.67 versus -0.82 from one week ago. Values closer to -1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation. With that in mind, while the inverse relationship is cautiously weakening, it still remains predominantly negative.

ASEAN-Based USD Index Versus Wall Street Index – Daily Chart

Chart Created Using TradingView

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/PHP

*Wall Street Index averages S&P 500, Dow Jones and Nasdaq 100 futures

-- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter