Singapore Dollar, Indonesian Rupiah, Malaysian Ringgit, Philippine Peso – Talking Points

- US Dollar selling pressure slowed, seeing gains and losses against ASEAN FX

- Bank earnings offer acute warning ahead of more reports as virus cases slow

- USD/SGD, USD/MYR, USD/IDR and USD/PHP continue eyeing market mood

US Dollar ASEAN Weekly Recap

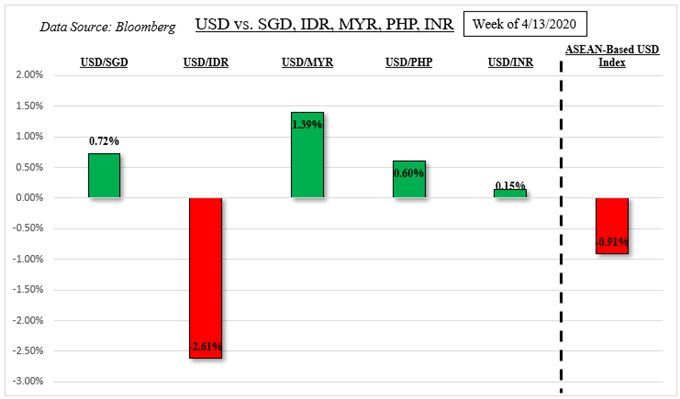

The US Dollar mostly aimed higher this past week against ASEAN currencies such as the Singapore Dollar, Malaysian Ringgit and Philippine Peso. It lost ground however to the Indonesian Rupiah, resulting in an overall down week for my ASEAN-based US Dollar index. Weakness in the haven-linked Greenback notably slowed as of late despite a cautiously optimistic mood on Wall Street as equities rose over the past 5 days.

The resilience in the Rupiah comes amid upbeat commentary from Bank of Indonesia’s Governor Perry Warjiyo who mentioned last week that intervention needs “have been largely reduced”. As I mentioned previously, the USD continued to focusing on external developments to find direction against currencies in the developing Asia Pacific region. This will likely remain the case in the week ahead.

Last Week’s US Dollar Performance

ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/MYR and USD/IDR

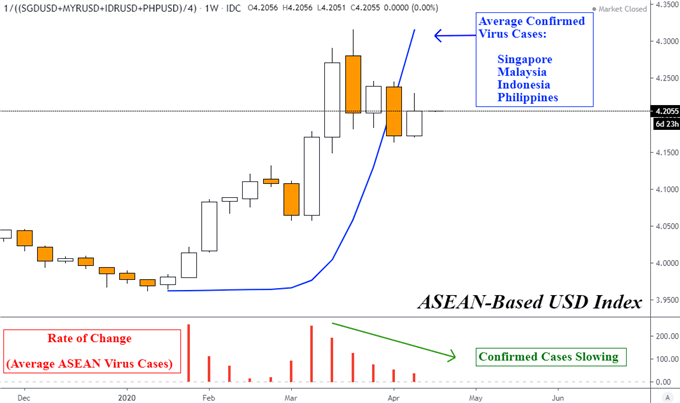

Confirmed coronavirus case growth in Singapore, Malaysia, Indonesia and the Philippines has been slowing on average. The weekly chart below overlays these cases alongside my ASEAN-based US Dollar index. The latter averages USD against SGD, MYR, IDR and PHP. This is also following the cautious easing in global reports such as in countries like the United States, Italy and France.

ASEAN Confirmed Coronavirus Case Growth Appearing to Slow – Weekly Chart

Chart Created Using TradingView

Earnings Season in Focus

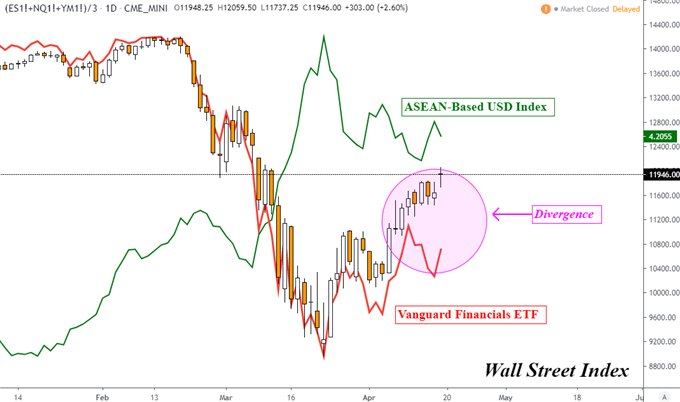

ASEAN currencies tend to follow broader market mood and that places the focus this week on the earnings season. Last week painted a rough picture for the road ahead as major US banks overwhelmingly disappointed expectations. On the next chart below, the Vanguard Financials ETF can be seen struggling against an average performance on Wall Street benchmark stock indexes.

What may follow is a similar picture with tech, manufacturing, transport and health care companies reporting in the week ahead. The latter may appear relatively rosy as governments undertake drastic measures to support general wellbeing. Companies that rely on online subscription services may also offer slightly more optimistic readings thanks to a bump from consumers staying at home due to social distancing measures.

Broadly downbeat guidance risks rekindling selling pressure in equities and reviving demand for the US Dollar. This is as local data continues to deteriorate. The Citi Economic Surprise Index tracking the United States continued falling deeper into negative territory last week. This suggests that economists are not necessarily appreciating the severity of what is anticipated to be an impending recession.

The International Monetary Fund (IMF) warned last week that the global economy could see the worst financial crisis since the Great Depression almost a century ago. Still, US President Donald Trump did announce reopening guidelines for the country last week. States like Texas and Minnesota took measures to ease social isolation measures. A pickup in coronavirus cases risks further deteriorating market mood.

Financial Stocks Diverge with Wall Street After Weak Bank Earnings

Chart Created Using TradingView

-- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter