Australian Dollar, AUD/USD, AUD/JPY, IG Client Sentiment - Talking Points

- Australian Dollar vulnerable to kneejerk volatility on US-Iran risk

- Positioning signals are arguing downside bias versus USD & JPY

- AUD/USD, AUD/JPY may accelerate declines on technical breaks

US-Iran Geopolitical Risk Fuels Australian Dollar Volatility

In this week’s session, I covered a broad-based overview of assets that experienced kneejerk volatility on US-Iran geopolitical risk. All eyes are on President Donald Trump’s statement on Wednesday after Iran “concluded proportionate measures” and is not seeking to start a war. For the time being, market pessimism has cooled. Where does that leave the pro-risk Australian Dollar using measures of conviction?

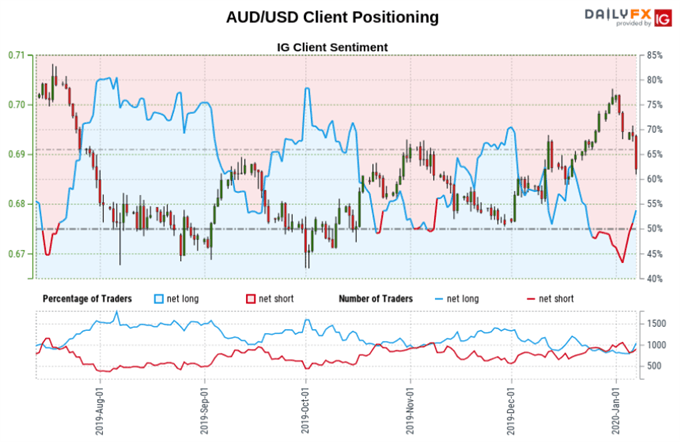

AUD/USD Sentiment Outlook

According to IG Client Sentiment, about 62.46 percent of AUD/USD traders are net long at the time of this writing. That represents an uptick from where positioning was earlier this month and coincidentally when prices topped at the onset of 2020. Now those biased to the upside are about 17.06% and 33.45% higher compared to yesterday and the past week respectively.

With that in mind, the combination of current sentiment and recent changes produces a stronger AUD/USD-bearish contrarian trading bias. From a psychological perspective, this shows rising speculation of a bottom in the pair. That may continue building in the near-term. This is as net-short positioning is broadly on the decline in recent days.

Technical Analysis

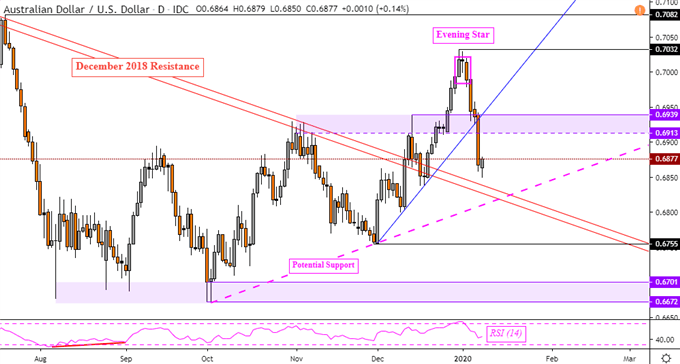

Focusing on technical analysis, AUD/USD extended its selloff after confirming a bearish candlestick pattern – as expected. Prices also took out near-term rising support from the beginning of December – blue line on the chart below. That has put the push above long-term falling resistance from 2018 into question. A descent through this psychological barrier would reinstate the focus on the pair’s dominant downtrend.

AUD/USD Daily Chart

AUD/USD Chart Created in Trading View

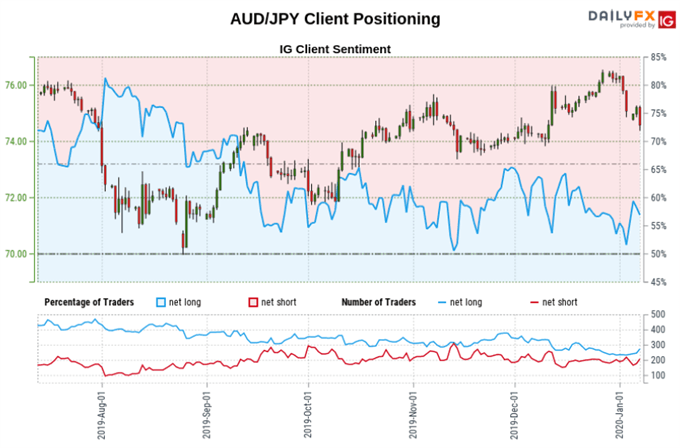

AUD/JPY Sentiment Outlook

A similar story is unfolding when comparing the Aussie to the anti-risk Japanese Yen. About 56.78% of traders are net long AUD/JPY. Upside bets have been on the rise, increasing 3.42% and 15.74% on a daily and weekly period respectively. The combination of current sentiment and recent changes gives a stronger AUD/JPY-bearish contrarian trading bias at this moment in time.

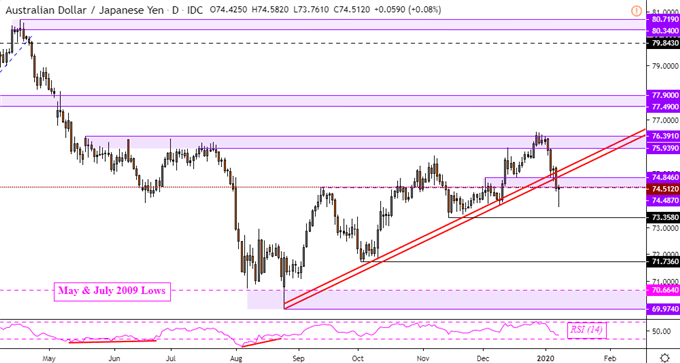

Technical Analysis

AUD/JPY has taken out key rising support from August 2019, red lines on the daily chart below. That has placed the medium-term uptrend at risk. Further confirmation is required from here to argue that a topping is in the cards. Immediate support sits below at 73.35 which if pushed through, exposes lows from October around 71.73.

AUD/JPY Daily Chart

AUD/JPY Chart Created in Trading View

*IG Client Sentiment Charts and Positioning Data Used from January 07 Report

--- Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter