US STOCKS OUTLOOK:

- U.S. stocks retreat after inflation hits a fresh four-decade high

- The impasse in peace talks between Russia and Ukraine also weighs on sentiment

- No follow-through to the upside after Wednesday’s violent rally suggests traders lack confidence in the broader market outlook

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most read: Russell 2000 Crippled by Rampant US Inflation & Stalled Russia-Ukraine Peace Talks

After the meteoric rally midweek, U.S. stocks failed to follow-through to the topside and moved loweron Thursday, a sign that traders continue to lean on the “sell the rip strategy” amid a lack of confidence in the broader market outlook.

At the closing bell, the S&P 500 declined 0.43% to 4,259, amid widespread weakness among the mega-darlings with the exception of Amazon, which jumped 5.48% after the company announced a 20-to-1 stock split and a $10 billion share buyback program. The Dow Jones also failed to build on the previous session's momentum and fell 0.34% to 33,174, re-entering into correction territory. The Nasdaq 100, for its part, underperformed its major peers and sank1.1% to 13,591, dragged down by higherbondrates.

Sentiment improved briefly yesterday on hopes for a de-escalation of the Russia-Ukraine conflict, but the mood on Wall Street changed after high-level negotiations between the two countries' foreign ministers yielded no meaningful progress towards a ceasefire or a diplomatic solution. With each day that the war drags on, the global economic outlook grows murkier, and the threat of further shocks increases. This environment is not conducive to sustained risk-taking.

Alarming inflation figures did little to calm nerves or provide comfort to investors during the trading session. According to the February report released by the U.S. Bureau of Labor Statistics, headline CPI jumped 7.9% y/y, while the core gauge surged 6.4% y/y last month, the highest reading since 1982 in both cases. The U.S. Treasury curve shifted upwards across the maturity spectrum after the data crossed the wires, with the 2-year yield reaching 1.73%, a level not seen since September 2019.

Inflation may not peak until later in the year, as the geopolitical crisis in Eastern Europe has reinforced the trend by causing disruptions in trade flows and by triggering a sharp rally in many commodities, from oil to grains to metals. This situation, coupled with the cooling of economic activity exacerbated by the Fed's tightening cycle, will continue to nourish "stagflation fears," fueling volatility and risk-off episodes. For these reasons, the S&P 500, the Dow and the Nasdaq 100 could retest their 2022 lows in short order.

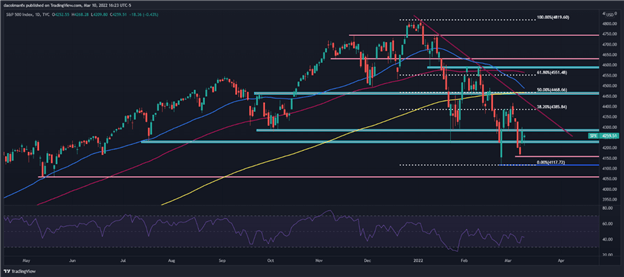

S&P 500 TECHNICAL ANALYSIS

The S&P 500 stalled at resistance and pivoted lower on Thursday as bears resurfaced to fade the recent upside move. If selling activity intensifies in the coming sessions, support is seen at 4,230 and then 4,157. If both of these floors are taken out, the index could be on its way to retest the 2022 low near 4,115. Alternatively, if market sentiment improves and prices resume their rebound, the first resistance to consider appears at 4,290, followed by 4,385, the 38.2% Fibonacci retracement of the 2022 decline.

S&P 500 (SPX) Chart by TradingView

NASDAQ 100 TECHNICAL ANALYSIS

The Nasdaq 100 failed to build on the previous day rally and dropped more than 1% amid cautious mood. With this pullback, the 2022 low remains the immediate downside focus, followed by the March 25 low. On the flip side, if the tech index reverses higher and regains bullish momentum, resistance lies at 14,060. If we see a move above this level (trendline resistance), price could charge towards cluster resistance in the 14,375/14,453 band.

Nasdaq 100 (NDX) chart prepared in TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Contributor