New Zealand GDP Preview:

- The Q2’19 New Zealand GDP report will be released on Wednesday, September 18 at 22:45 GMT and forecasts suggest a slowing rate of growth.

- Even if the RBNZ keeps rates on hold at its September policy meeting, rates markets are favoring another 25-bps rate cut at the November RBNZ meeting.

- Retail traders have remained net-long since July 23 when NZDUSD traded near 0.6720; price has moved 5.6% lower since then.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

09/18 WEDNESDAY | 22:45 GMT | NZD Gross Domestic Product (2Q)

The New Zealand Dollar has been able to claw back some of its August losses – it was the worst performing major currency last month – as risk appetite has been buoyed in early-September. But now that the Q2’19 New Zealand GDP report is coming into focus, the New Zealand Dollar may come back under pressure amid renewed rate cut speculation.

Cooling tensions around the US-China trade have reduced the immediate need for an ‘insurance cut’ to cushion the New Zealand economy, if only slightly. Yet a Bloomberg News forecast still shows the New Zealand economy is due to slowdown from 2.5% annualized growth in Q1’19 to a 2.1% pace in Q2’19. Even so, expectations around the timing of the next RBNZ interest rate cut have been pushed back, per overnight index swaps:

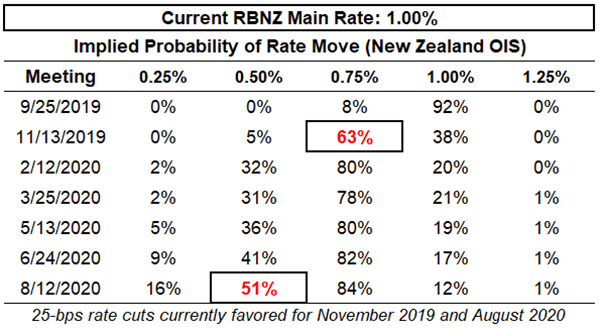

Reserve Bank of New Zealand Interest Rate Expectations (September 16, 2019) (Table 1)

According to overnight index swaps, the odds of the RBNZ cutting rates in September have decreased since we last checked in, from 13% to 8%. But rate markets still believe that a policy shift is coming in November, as overnight index swaps now imply a 63% chance, as opposed to a 67% chance in the first week of September, of a 25-bps rate cut in November – the last RBNZ meeting of the year. If there is another 25-bps rate cut over the next year, rates markets have pushed back the timing from June 2020 (52% last week) to August 2020 (51%).

Pairs to Watch: AUDNZD, NZDJPY, NZDUSD

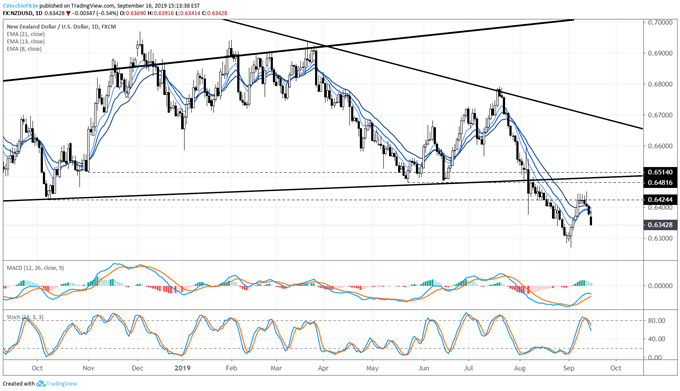

NZDUSD Technical Analysis: Daily Rate Chart (September 2018 to September 2019) (Chart 1)

NZDUSD rates staged an impressive recovery at the start of September, but the bearish outside engulfing bar on Thursday, September 12 has seen follow through to the downside. The 2018 low at 0.6424 served as resistance during the early-September rebound, suggesting that downside pressure remains strong. Indeed, the break down through the ascending trendline from the 2015 and 2018 yearly lows suggests longer-term downside potential.

Momentum is turning negative again, with price below the daily 8-, 13-, and 21-EMA envelope (albeit not in sequential order). Slow Stochastics are declining from overbought territory, while daily MACD has halted its run higher in bearish territory. A return to the 2019 low at 0.6269, the bullish outside engulfing bar set on Tuesday, September 3, isn’t out of the question.

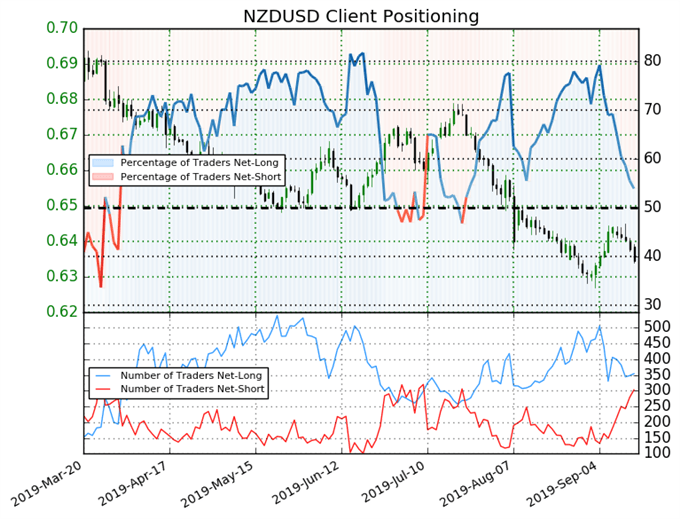

IG Client Sentiment Index: NZDUSD Rate Forecast (September 16, 2019) (Chart 2)

NZDUSD: Retail trader data shows 53.9% of traders are net-long with the ratio of traders long to short at 1.17 to 1. In fact, traders have remained net-long since July 23 when NZDUSD traded near 0.6720; price has moved 5.6% lower since then. The number of traders net-long is 2.6% higher than yesterday and 9.7% lower from last week, while the number of traders net-short is 2.0% higher than yesterday and 79.3% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests NZDUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger NZDUSD-bearish contrarian trading bias.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX