Talking Points:

- The March Canada inflation report is due on Wednesday, April 17 at 12:30 GMT.

- The ongoing rebound in energy prices over the past several months means that Canadian inflation data should have stabilized.

- Retail traders remain net-short USDCAD, and recent positioning changes suggest price may continue lower.

Join me on Mondays at 7:30 EDT/11:30 GMT for the FX Week Ahead webinar, where we discuss top event risk over the coming days and strategies for trading FX markets around the events listed below.

04/17 WEDNESDAY | 12:30 GMT | CAD Consumer Price Index (MAR)

The ongoing rebound in energy prices over the past several months means that Canada inflation data should have stabilized; Crude Oil prices were up another 5.1% in March and were up by 32.5% in Q1’19. As a result, a Bloomberg News survey forecasts thatheadline CPI is due in at 1.9% (y/y), a meaningful increase from 1.5%, and the monthly reading is due in at 0.7% (m/m), as it was in February.

It still holds that improvement in energy markets will help the Canadian Dollar and inflation rebound hand-in-hand. As such, traders should keep expectations low for a policy change from the Bank of Canada any time soon; expectations have moved lower in recent weeks. At the start of April, overnight index swaps were pricing in a 24.3% chance of a 25-bps rate cut by July; now, odds are only 12%.

Pairs to Watch: EURCAD, CADJPY, USDCAD

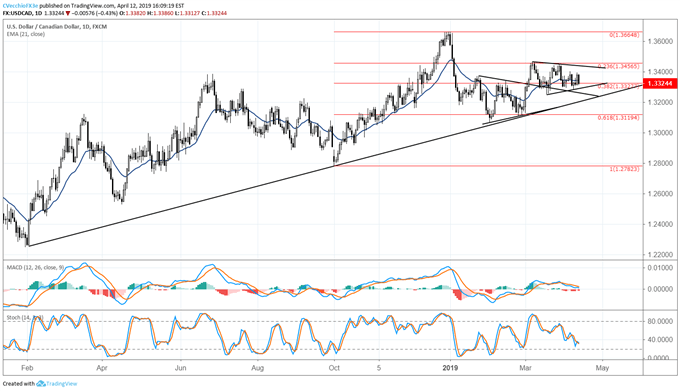

USDCAD Technical Forecast: Daily Price Chart (January 2018 to April 2019) (Chart 1)

A clear lack of follow through to the topside in USDCAD following the breakout from the early-2019 symmetrical triangle resulted in…another symmetrical triangle. USDCAD price has been consolidating since early-March once more, trading between the 23.6% and 38.2% retracements of the Q4’18 high/low range; the symmetrical triangle from January to early-March consolidated between the 38.2% and 61.8% retracements. If USDCAD price is able to break lower, near-term levels of interest are the April low at 1.3284 and the March low at 1.3251 (concurrently where the rising trendline from the February 2018, October 2018, and March 2019 lows intersects next week).

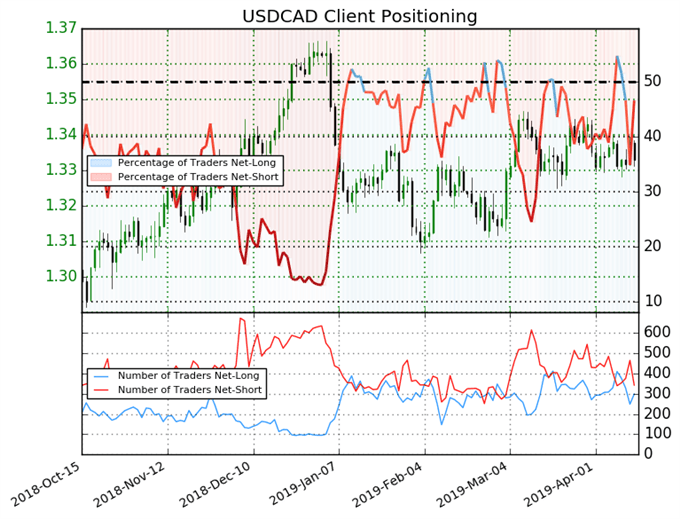

IG Client Sentiment Index: USDCAD (April 12, 2019) (Chart 2)

Retail trader data shows 46.6% of traders are net-long with the ratio of traders short to long at 1.15 to 1. The number of traders net-long is 18.7% higher than yesterday and 11.0% lower from last week, while the number of traders net-short is 30.2% lower than yesterday and 20.3% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDCAD prices may continue to rise. Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current USDCAD price trend may soon reverse lower despite the fact traders remain net-short.

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX