Article Summary: Traders often look to retracements for safe entries in the direction of the overall trend. While that is recommended, it is near impossible to find a retracement on a Daily chart like EURJPY when a currency pair has moved thousands of pips in a few month’s time. Moving down a time frame can help you find an appropriate entry on an apparent “runaway” trend.

The current trending market has been a utopia for trend following trader. However, with the Japanese Yen (JPY) plummeting along with the Great British Pound (GBP) and ecstasy of the Euro (EUR), many traders are confused when and if they should jump in. This article will give you a few ways of using Ichimoku so that you don’t miss out when the trends keep moving and you're afraid to miss out.

Fundamentally Speaking:

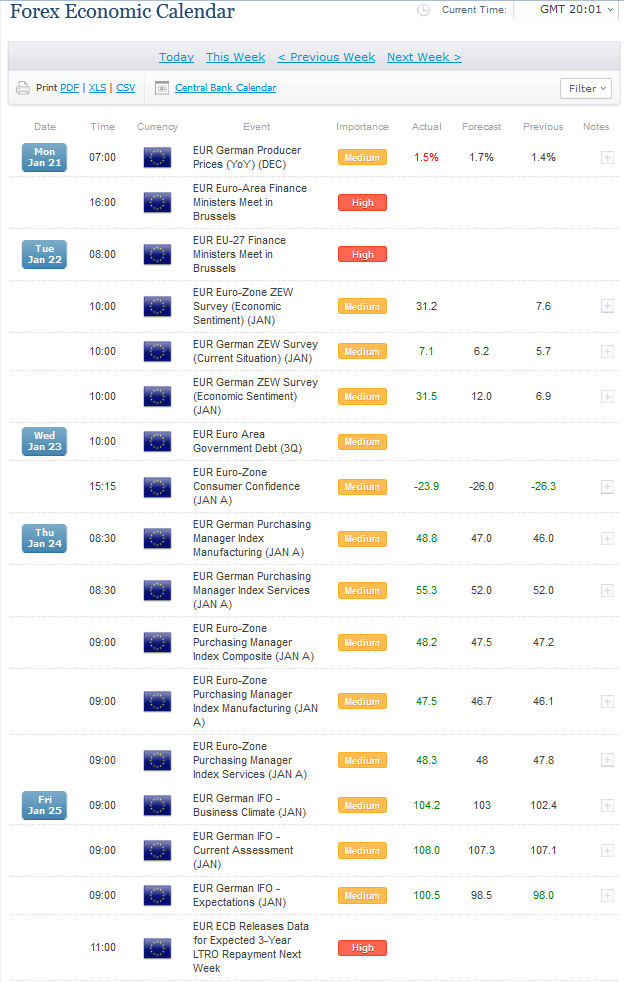

The Economic news and the charts tell us that the EUR is back and trending higher with a vengeance. Even though we may see some pull backs (and let’s hope that we do for good entries) the Economic news that keeps coming out of Europe is positive. If you take a look at the DailyFX Economic Calendar over last week, you can see clearly that the majority of releases were better than expectations (as indicated by green numbers on the ‘Actual’ column).

Learn Forex: DailyFX.com Economic Calendar Can Help You Spot Overall Market Sentiment

(Courtesy of Dailyfx.com/Calendar)

This Calendar’s data on the Eurozone means that you have fundamental and technical reasons to stay bullish on the Eurozone. In terms of a Currency War, it also appears that the Eurozone is not looking to be as aggressive as the other major economies.

Ichimoku Trading Tip – Finding Entries When the Daily Chart Trend Won’t Stop

Many of you can see that the EUR is the strongest currency across the board and the JPY is the weakest. One thing that can help you time an entry after you’ve realized what pairs to focus on is to concentrate on a smaller time frame. The rules stay the same when looking for Ichimoku entries but because you’ll receive more signals you want to make sure you’re taking trades in direction of the overall (Daily Chart) trend.

Learn Forex: Using Technical Analysis on Multiple Time Frames Can Help You Spot Entries

(Created by Tyler Yell)

Looking above, we’ve placed a EURJPY Daily chart next to a EURJPY 4 hour candle chart. When looking to a smaller time frame for signals, we recommend you look down aound 1/5th of the current time frame. You will see highlighted sections that show you on the Daily Chart where you would have entered based on the 4 hour chart. Naturally, we will only look to the 4 hour chart if the Daily chart is in such a strong trend that it’s hard to find a strong entry based on Ichimoku rules.

If this is your first reading of the Ichimoku report, here is a recap of the rules for a buy trade:

-Price is above the Kumo Cloud

-The trigger line (Tenkan-Sen) is above the base line (Kijun-Sen) or has crossed above

-Lagging line is above price action from 26 periods ago (not pictured above for clarity)

-Kumo ahead of price is bullish and rising (displayed as a blue cloud)

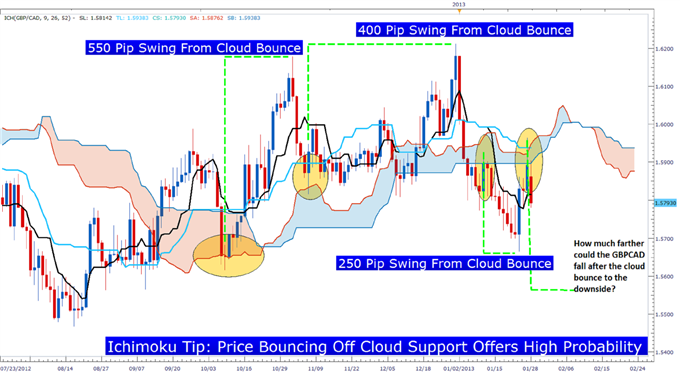

Ichimoku Weekly Trade: Sell GBPCAD Off Of Cloud Bounce to the Downside

Every week, you are introduced to a trade that abides by the Ichimoku trend trading rules. Outside of the JPY, the GBP is the weakest currency among majors. This means that you simply need to find a stronger currency trading against the GBP that is giving you an attractive entry. As per Ichimoku rules, the currency with an attractive entry against the GBP right now is the Canadian Dollar (CAD).

When utilizing Ichimoku to spot good entries in the direction of the trend, bounces off the cloud while honoring the other rules can provide great entries which we see with GBPCAD.

Learn Forex: GBPCAD is bouncing off the Cloud Which Has Led to Large with Trend Move Recently

(Created by Tyler Yell)

With the chart above, we’ve been short since the first full candle closed below the cloud on 1/17. Because the other Ichimoku rules were met with the Trigger Line (Black) already below the Base Line (Baby Blue) before entering a buy trade.

Ichimoku Trade: Sell GBPCAD as all Ichimoku rules are aligned and price has bounced off the cloud.

Stop: 1.5975 (currently the top of the cloud)

Limit: 1.5550 (as of current price, this limits looks for a similar bounce of roughly 250 pips off the cloud)

The cloud lies at the heart of Ichimoku and for good reason. The cloud’s dynamic form of support and resistance offer great trading signals with well managed risk when entering back into the direction of the overall trend. No trading system is perfect and that includes Ichimoku but the ability to trade price bouncing off the cloud makes this a system that manages risk and offers strong entries.

Happy Trading!

---Written by Tyler Yell, Trading Instructor

To be added to Tyler’s e-mail distribution list, please click here.