Traders around the world are increasingly confounded as to how to trade the US Dollar. After multiple scares and momentum shifts pertaining to debt limits, potential Quantitative Easing, and of course – sovereign debt downgrades, many folks are throwing up the white flag on the Greenback and instead choosing to speculate on cross pairs such as EUR/AUD, GBP/NZD, or perhaps even EUR/CHF.

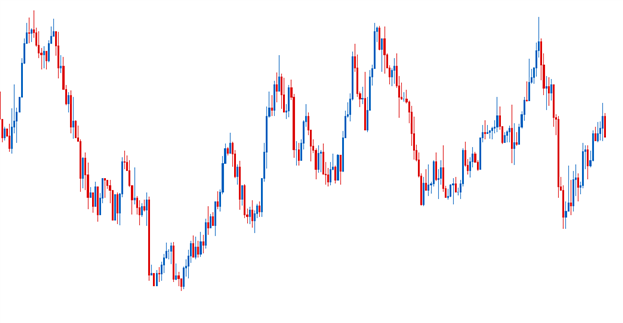

Focusing on cross pairs (that do not include the US Dollar) can be an extremely prudent strategy in markets in which the US Dollar looks like this:

Chart by James Stanley

By avoiding the US Dollar, traders can potentially focus on strong trending moves that can be found in the aforementioned ‘cross’ pairs.

But what if the trader was adamant about trading the US Dollar? Perhaps it’s because of the liquidity behind Dollars, or maybe the trader was welcoming the increased volatility that the Greenback is showing us?

To those traders – formulation of strength analysis can add a large arrow in their trading quivers.

By noticing that the NZD/USD currency pair is in the process of formulating an all-time high (currently sitting 70 pips from this level), traders can gleam that in the event of US Dollar weakness; being long the Kiwi-Dollar might not be a bad place to be.

Chart by James Stanley

Now that can be great if the US Dollar is weakening; but as we saw in the first chart of this article – the US Dollar also has the propensity to strengthen. What pair can the trader look to in these events?

Once again, I’m going to draw to the strength analysis that I’ve performed. During a good portion of the US Dollar volatility we looked at earlier, the Euro Zone faced quite a few hardships in regards to the sovereign-debt of their nation-state constituents. As a matter of fact, when I perform my strength analysis, the Euro consistently comes up towards the bottom of the list of my strong competitors.

Let’s take this point a little further.

If the US Dollar is strengthening, what situations are we generally looking at as a trader? We know that rate hikes out of the US are probably not coming any time soon (given recent verbiage from Bernanke). We also know the fundamentals of the US economy don’t look so bright (confirmed by speeches last week given by Bernanke). So the primary situation in which we will probably be seeing US Dollar strength would be a ‘flight-to-quality,’ in which traders eschew higher rates of return – instead – for safety of principal. Those are the panic situations we discuss in the DailyFX+ Trading Room.

In that situation – I want to be short on Euro’s – or short the economy with the highest potential for showing us bad news. In these events, I want to look to short the EUR/USD currency pair to take part with my fellow traders in this ‘flight-to-quality.’

Chart by James Stanley

Next: China "Big Trading Opportunity in World's Second Largest Economy" (21 of 48)

Previous: The US Dollar: The World's 'Safe-Haven'

To join James Stanley’s distribution list, please click here.

Thank you very much for your time, and Happy Trading!