Talking Points:

- Strong support at 0.8650

- AUD/USD SSI hits 5-month high, +2.55

- Daily close below 0.8650 could trigger a sell trade

It’s been two weeks since I last wrote about the Aussie Dollar, and during that time we have seen a lot of uncertainty. There has been no clear progress made up or down as it’s stayed within a 250 pip range. But as with all market ranges, there will be a time when the range will end. Today, we look at a bearish breakout trade that could occur in the next couple days.

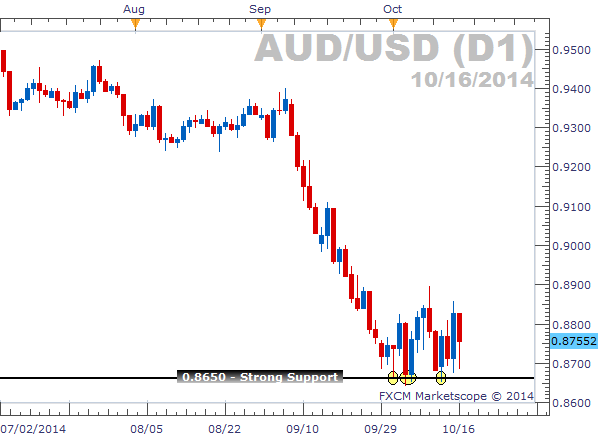

Strong Support Level – 0.8650

At the bottom of the range, we have seen a very strong support level at 0.8650. Price has touched and temporarily broken this level several times, but we have not had a confirmed daily close below this level. On the following daily chart, notice how strong the downtrend was in the month of September. There were hardly an retracements as price plunged from 0.9400 down to the AUD/USD's current range between 0.8650 and 0.8900.

Learn Forex: AUD/USD Daily Chart – Strong Support

(Created using FXCM’s Marketscope 2.0 Charting Package)

As clear as the downtrend was in September, the range bound nature of the Aussie this month is almost just as clear. At some point we expect price to break either above or below this range, but I have my own direction bias based on recent developments in retail trader sentiment (SSI).

AUD/USD SSI 5-Month High - Bearish

Retail traders have been net long the AUD/USD since late July and the amount of traders buying has increased over time. In past reports, I've noted SSI equaling +2.00, +2.25, and now +2.55, its highest level in 5-months. (For a quick guide on sentiment, check out my article that explains how to use the SSI.)

Learn Forex: AUD/USD Historical SSI, 5-Month High

(Created using DailyFXPLUS.com’s Speculative Sentiment Index)

The historical SSI chart above shows just how high SSI has become lately and also how price has moved during times of positive SSI readings in the past. When we have most retail traders buying, it is usually a time to look for selling opportunities. So, I am favoring placing a short position on the AUD/USD if we see a daily close below 0.8650.

Trade Entry Logic and Profit Targets

If and when the AUD/USD is able to break through its previous low, it could then be difficult to come up with a profit target; since we have not seen the Aussie at these levels in quite some time. It's difficult to locate potential support levels. But what I've created on the chart below are potential support levels based on the Fibonacci Expansion tool.

Learn Forex: AUD/USD Sell Breakout – Fibonacci Expansion Profit Targets

Drawing the Fib Expansion from high-to-low and then to its retracement level, it projects two primary levels that could act as our profit targets. The 61.8% expansion sets up a profit target around 0.8430 and the 100% expansion, a target around 0.8140. We could set our limit at either one of these levels or evenly split them between both. But we do want to make sure we use a positive risk:reward ratio. I recommend using 1:2.

Patience is a Virtue

With the abundance of volatility we have seen, it is expected that the AUD/USD will break out of its range soon (hopefully to the downside). With SSI in our favor and a couple of support levels to target, we just need to wait until a daily candle closes below 0.8650. To trade the AUD/USD risk-free and use the tools written about in today's article, download a Free Forex Demo account with real time charts.

Good trading!

---Written by Rob Pasche

Start your Forex trading on the right foot with the Forex Fast-Track Webinar Series. This 4-part, live webinar course is the disciplined Traders’ Fast-Track to the Forex Market. Topics include:

- Using FXCM’s award-winning trading platform

- Calculating Leverage and reducing risk

- Trading with a simple (yet effective) trading strategy

- Maintaining for Forex account and enrolling in on-going education

This course is completely free, so sign up or watch on-demand today.