Article Summary: A simple Forex strategy used by traders is a price breakout strategy. Here are 4 easy to follow steps to trade a price breakout and manage that risk.

You have probably heard the phrase “buy low and sell high”. This phrase permeates many different markets from real estate to automobiles. However, there are times, when you actually want to buy higher while selling lower. A breakout strategy does just that and it tends to work best during volatile market conditions or in strong trends. Today, we’ll discuss a 4 step strategy to trading breakouts in Forex.

Here are the 4 steps to identifying your Forex breakout trade.

- Add the Donchian Channel indicator (DNC) to your chart

- Identify the direction of trend

- Enter on a break of the DNC using entry orders

- Exit on a break of the opposing DNC using a stop loss

Let’s unpack each step of the strategy further.

The Donchian Channel Indicator

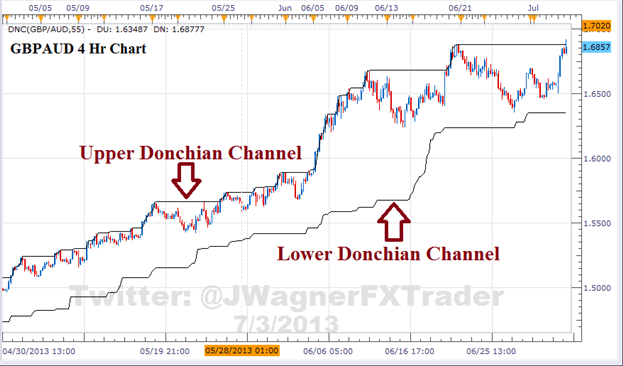

Add the Donchian Channels indicator to your intraday chart (between 1hr and 4hr charts) with an input setting of 55.

Learn Forex: The Donchian Channel Indicator

If you wish to utilize longer time frame charts such as a daily chart, then follow these steps in how to trade Forex in your spare time. Trading from a daily chart will offer less trading signals and you will be in the trades longer versus an intraday chart which offers more signals with some of those signals being less reliable.

Identify Your Trend

As with any strategy, at DailyFX Education we recommend that you filter your trades solely in the direction of the trend. There are many benefits to following trends. Two benefits of trend trading include being bailed out of having an imperfect strategy and there are more pips available in the direction of the trend. Therefore, trading with the Donchian Channels is no different and we want to incorporate a way to filter our trends and bias our signals.

Add Your Entry Order

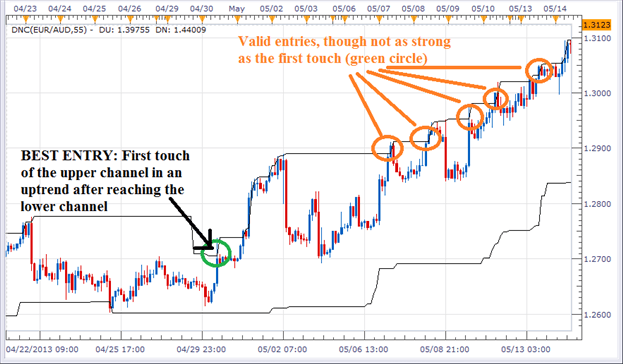

Once we have determined a trend bias, identify the entry price by incorporating the trend and Donchian Channels together.

Learn Forex: Entries with the Donchian Channel Indicator

For example, in an uptrend, we want to buy 1 pip above the upper Donchian Channel. The best signal occurs on the first occasion where the upper Donchian Channel is reached. Subsequent breaks of the upper channel are ok, but the trend is a bit more mature and therefore, more likely to reverse.

In a downtrend, we want to sell 1 pip below the lower Donchian Channel. Again, the best signal occurs on the first occasion where the lower Donchian Cchannel is reached.

Add Your Exit Order

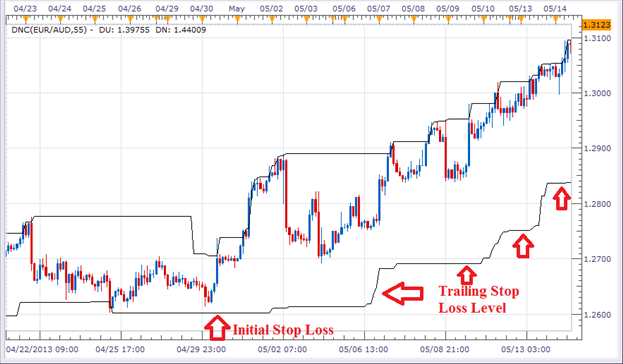

Once you have determined where to get in, it is important to know where to exit the trade. This strategy utilizes a manual trailing stop which is how many professionals manage their stops. For the purposes of this strategy, the trailing stop is located at the same price as the opposing Donchian channel.

Learn Forex: Exits with the Donchian Channel Indicator

For example, if the trend is up, then we will use the lower Donchian channel as the stop loss. If you remain in the trade long enough, then over time, the lower Donchian channel and your stop loss will begin to move in your favor. The longer you are in the trade, the more favorable the trailing stop moves in your direction.

Conclusion

Many traders often ask if they can trade breakouts without having to use the Donchian channels indicator. The answer is yes, of course. The basic elements of a Forex breakout strategy remain the same. Look for a level of support and resistance, and play a price break of those levels.

As with any strategy, your entry and exit rules are just a couple pieces to the trading plan puzzle. Make sure your risk is commensurate to the size of account you are trading. In our DailyFX EDU courses, we talk about risking less than 5% of your account on all open trades.

Happy Trading!

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX Education

Follow me on Twitter at @JWagnerFXTrader.